In the last 10 days bund sell-off finally took a breather and EUR yield curves dropped significantly as it was the case with US Treasuries in April. In this brief article we are analyzing the latest move and looking at the potential drivers.

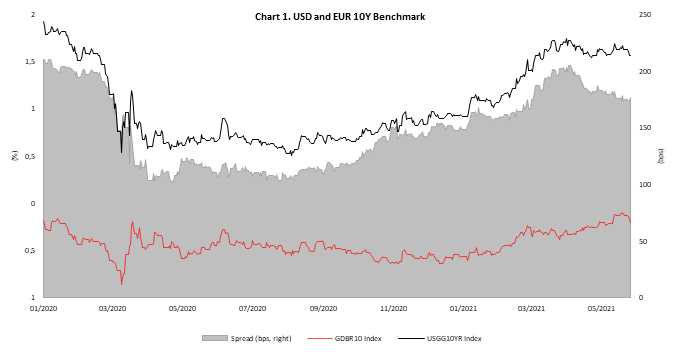

US 10Y yield was rising for several months and hit 1.75% in the end of March and then foreign investors decided to step in. In that period UST-bund spread widened significantly and overjumped 200bps level as investors believed in Lagarde’s message that ECB should not let external factors to tighten EUR policy and European recovery story lagged the one in US. However, things changed in April with Treasuries being bid by foreign investors and big short on treasuries was closing while EUR curves weren’t saved by larger PEPP purchases as investors started to question higher inflation in Europe too. EUR yield curve steepened and 10Y yield rose above -10bps in early May for the first time since March 2020.

Source: Bloomberg, InterCapital

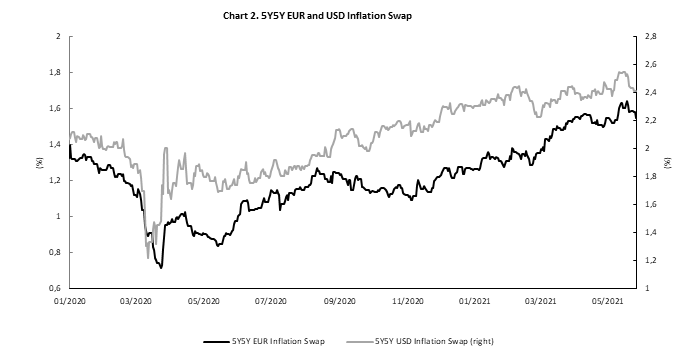

As mentioned above, accelerated sell-off in bunds lasted for several weeks as investors were pricing faster economic recovery and inflation expectations were on the rise. Just to put things into perspective, Eurozone’s YoY HICP stood at 1.6% in April, the highest level since April 2019 while 5y5y inflation swap touched 1.60%, the highest level since 2018. As it was the case with US treasuries in April, sell-off cannot last forever and it seems that last week investors finally decided that bund was too low as inflation and economic recovery could be calculated in full. Hence, in the last 10 days, EUR 10y yield went from above -10bps to below -20bps once again while inflation expectations decreased a bit (chart 2.). Despite economic recovery is almost inevitably in front of us and inflation pressures are evident in every economic release, market just can’t ignore enormous amount of dovish comments by both Fed and ECB officials which are ensuring investors that inflation pressures will show to be only transitory and that monetary stimulus is still needed in full. The latest comment came from ECB’s council member Villeroy (dove) this week who stated that ECB has “well beyond June meeting” to decide whether to decrease PEPP, lowering chances that Ms Lagarde could announce step back in PEPP to the pace from Q1 on their next monetary policy meeting on June 10th. Furthermore, Mr Villeroy said that APP could become more flexible which is expected to be natural successor of PEPP once pandemic is over as market will most likely need some bridge from PEPP to “no-PEPP” era. On the other side of the Atlantic there is discussion on whether Fed should taper their purchase programs as inflation is surging at the fastest pace in decades. However, it is still not clear whether Fed could taper in the next few months although some analysts expect Mr Jerome Powell to announce slower purchases in Jackson Hole at the end of summer when we could also see whether inflation will show to be transitory or not. In any case, central bankers succeeded in calming yield curves for now despite of strong inflation pressures and in case inflation shows to be here only for the rest of 2021 it will show that both Fed and ECB did their job perfectly. However, if inflation shows to be more stubborn than central bankers expect it to be, they will have to react more abruptly and hope that they are not behind the curve too much. For now, investors believe in their transitory story. The main question is whether investors’ patience supported by central banks will be stronger than inflation pressures. As always, markets will show. However, for this one we could wait for several months or even quarters or at least until all of the base effects are out of the system.

Source: Bloomberg, InterCapital