After the almost linear rise in bond yields since the beginning of August, the Bank of England’s intervention to save some UK pension funds restarted another pivot talk which coupled with several bad economic data released this week and low liquidity resulted in a dramatical drop in yields across the globe. In this brief article, we are looking at recent events and analyzing whether we could see another prolonged bond-buying period as we saw in the summer.

This year we have seen two bond rallies and markets are questioning whether we are now in the midst of the third one. The first one was due to risk-off driven by Russian aggression on Ukraine, but investors rather quickly realized that inflation would continue creeping higher backed up by skyrocketing commodity prices. Another rally started at the beginning of summer after a significant drop in bond prices and lasted for almost two months. The rally was driven by recession and pivot talks but also by low liquidity in the summer months. In the mentioned period bund yield went from 1.92% to 0.70% while the yield on 2Y German paper went to almost zero from 1.2%. Nevertheless, during the summer, economic data was rather mixed while inflation continued higher and central bankers showed that they will focus on inflation even in the case of modest recession. In its September meeting, ECB showed its hawkish side by lifting the rates by 75bps and even mentioning QT which is to be discussed these days in their non-monetary meeting. On top of inflation worries, a mixed economic picture, and now very hawkish central banks around the world, UK’s plans to cut taxes to support its economy made the perfect storm for UK’s assets. Namely, the 10Y GILT yield went from 1.75% in early August to slightly above 3.0% in mid-September and then shot up to 4.50% in just one week. As bond markets around the developed world have a correlation close to one another, yields skyrocketed in US and Europe simultaneously. However, as my colleague Ivan wrote in his last week’s piece, several UK pension funds had difficulties with liquidity which prompted BoE to step into the bond market with temporary QE worth some £65bn (pouring them in long-dated gilts within two weeks).

BoE intervened on Wednesday and saved UK’s financial institutions but still it intends to exit from this temporary QE on October 14th and then start with QT on November 1st. This move should be seen as a quick fix in respect of financial stability rather than a monetary policy tool and it is to be seen what will happen with the cash market once the BoE is out. In any case, this is also the first victim of the aggressive tightening of central banks. On top of that, during the weekend there were some stories that Credit Suisse has some difficulties but still, it is not clear what were the drivers of the story besides the drop in the stock price and rise of CDS on the bank. You can imagine the feeling across the globe once investors think about a big bank failing (zeitgeist on September 18th, 2008). Furthermore, in the first two working days of October, we saw a strong fall in the US JOLTS versus the previous month and ISM fell across the sectors. Summing up all the above news, one should not be surprised that we have seen bond yields dropping like a rock, but these moves that we have seen were really something. From their peak, bund yield fell by 50bps while BTPS yield fell by 75bps. Gilts’ yields dropped way more on the BoE and the news that UK’s newly appointed PM will try to lower UK’s debt.

So, where do we stand now? It is obvious that an aggressive hike in central banks’ rates will have some consequences for the real economy, and we saw the first ones. However, it is still to be seen whether central banks will be eager to pivot quickly as they did in 2022. We think that they will be able to pause and go on autopilot for some time and that is the optimistic scenario in which inflation is falling constantly due to lower demand in a recession. More likely we will see more of these changes in narrative and increased volatility in rates.

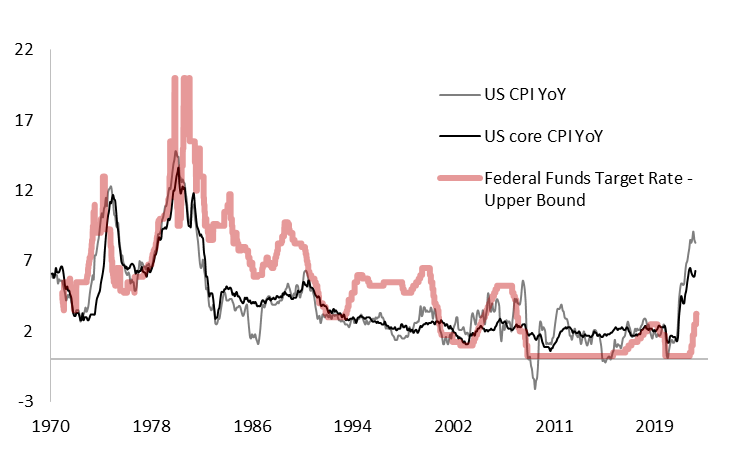

Chart. US Inflation and Fed Funds Rate

Source: Bloomberg, InterCapital