In late winter this year yields surged rapidly on reopening optimism and inflation fears. In other words, we had a tantrum with tapering still being on the long stick. Financial markets thought they knew Jerome Powell’s business better than he did and were subsequently proven wrong. Can we have it the other way in months to come? Can we have the taper without the tantrum after we have seen tantrum without the taper? Find out in this brief research piece.

If you had fallen asleep in early January (right after the Georgia run off) and woke up all of the sudden in mid-August, by just looking at German Bund yields you would conclude that it was a pretty boring year so far. Bund yields are currently trading exactly at the same levels as recorded back at the very beginning of the year, that is in the neighborhood of -0.50%. This means that after a volatile first semester of 2021, inflation fears augmented by taper/rate lift off prospects subsided to the level of diminishing altogether. So what has happened between early spring (peak rates) and now?

Well, the pandemic is simply not going away as we all hoped it will. Although in the United States vaccination and reopening are going mostly as planned, the rest of the world is staggering and we’re seeing a resurgence of Covid (delta variant) in the emerging markets with ripple effects being felt across the globe. In India, only about 31% of people were vaccinated with at least one dose, while merely 8% of population was fully vaccinated. Similar figures are reported across emerging Asia. In the developed world breakthrough cases (infections reported among fully vaccinated people) are on the rise, albeit symptoms tend to be milder so hospitalizations are quite rare. Nevertheless, the surge of breakthrough cases caused developed countries to consider a third dose (so-called booster shots) in order to provide a backstop to the spread of delta variant. Yesterday evening US President Joe Biden announced that booster shots would be available to everyone from September 20th.

On top of all that, a chain of events unfolding in the Chinese economy could only be accurately described by the word awkward. First of all, early this year the ruling party prevented the largest tech IPO in history (Ant was expected to raise 37bn USD and reach a 300bn USD valuation). However what came next was truly amazing. The Chinese regulators gave a green light for ride hailing app Didi to list and collect 4.4bn USD of cash, only to suspend registering of the new users just the following day after the IPO. Reasoning behind this action was the handling of personal data, but the message was clear: the communist party is in control of the markets, and not the other way around. On June 30th (IPO day) Didi was worth 87bn USD and one month later the valuation stumbled to below 50bn USD. In the following days crackdown ensued on gaming and private schools, just so the message is as clear as it can be. To the foreign investors the message was clear early on: Cathie Wood’s ARK cut all their exposure to Chinese tech, with plenty other investors doing pretty much the same thing. Some observers estimate that when and if Ant does the IPO, it would probably collect as much as 40% of what was expected last year. The tech crackdown is likely to remain in vivid memory of foreign investors, meaning that it will take time for the confidence of foreign investors in Chinese economy to be restored.

The resurgence of delta variant and Chinese tech crackdown are the reason equities were trailing relatively badly in recent weeks and consequently fixed income was faring much better. In the coming months we would be looking for US tapering announcement, probably on September 22nd FOMC meeting. The tapering of asset purchases would probably start before the end of the year at a very gradual pace of about 15bn USD cuts per FOMC meeting (FED currently buys 120bn USD securities per month on a net basis). At this pace the FED would phase out the asset purchases altogether by the end of 2022, unless the economic recovery slows down. With this very gradual pace of tapering, it’s possible the tantrum part would be absent in this tightening cycle since tapering would pretty much be matched by lower US Treasury placements.

Lower demand will hit lower supply, in other words.

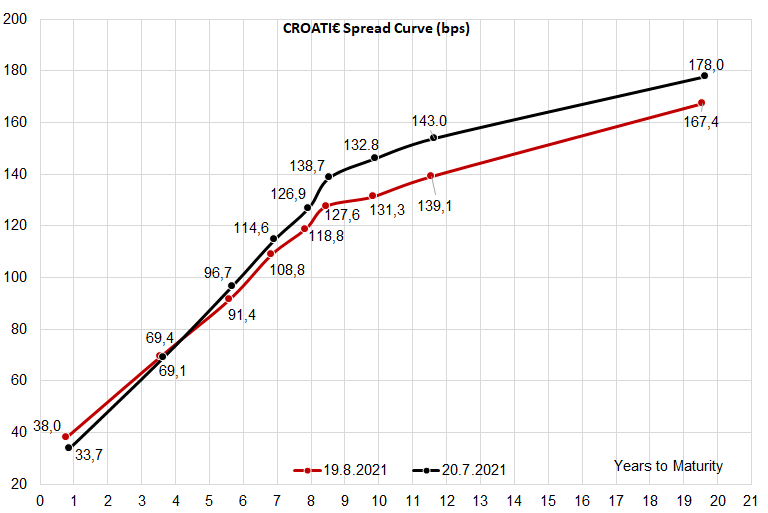

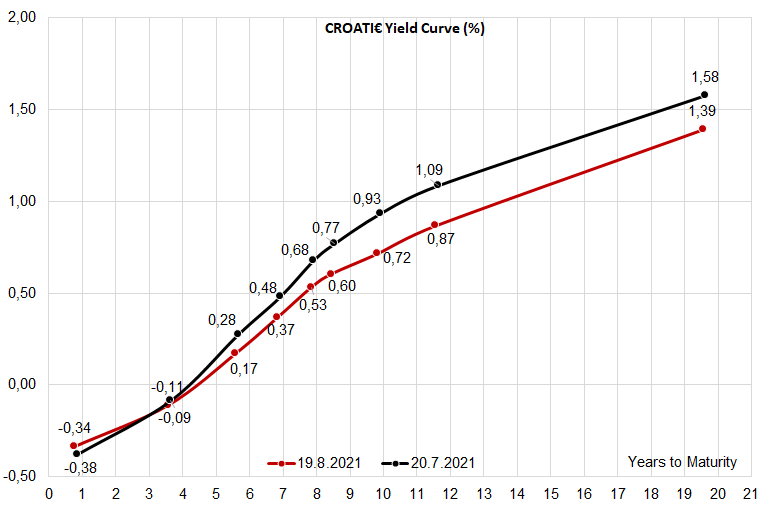

How are Croatian international bonds faring in a regime like this? With dropping DM yields CROATIs have been following suit, but more importantly the longer end has even recorded spread tightening. CROATI 1.5 06/17/2031 is currently traded at 0.72% YTM (107.37 clean price, B+131.3bps) and seasoned traders remember that in January the yields went down as low as 0.50%. In an environment of pending tapering announcement it’s quite unlikely that asset managers would continue to aggressively add more long positions on top of the ones they already have. It’s more likely that we’re entering a period of thin trading before the tapering message gets clear – more importantly, until it becomes clear what other major central banks are going to do with FED phasing out their asset purchase program.