On Valentine’s Day, US CPI was released and both headline and core CPI were higher than consensus on a year-over-year basis. As soon as the data was released, the UST 10Y yield plummeted to 3.62% and then rose to 3.80%, but the market reaction was bland other than that. In this article written by Kristijan Božić and Marin Onorato, we are looking into details of the recent inflation print.

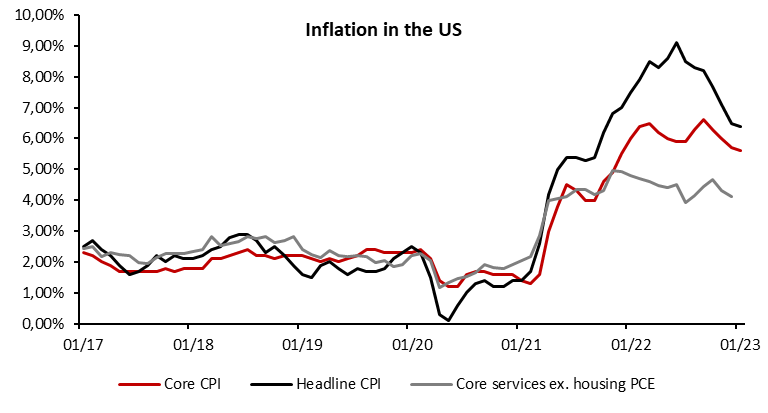

To analyze the latest inflation print correctly, we must consider the components of inflation. Energy inflation went slightly upwards on the yearly basis, but slower growth in the prices of commodities negated the faster growth in energy inflation. Food inflation is still high historically, but the downtrend since October 2022 is clear. The crux of the inflation problem is services inflation which has been close to 2.0% until 2022. Since the start of 2022, the rate doubled and currently, it is running around 4.0% which is a problem for Mr. Powell and other Fed Council members because of its stickiness. As long as services inflation keeps growing, no one can be sure of the Fed easing the monetary policy. Also, Mr. Powell keeps reiterating the importance of PCE core services excluding housing, which is stubbornly high as shown on the chart, slightly north of 4.0%. If that measure keeps being well above the inflation target, the labor market is unbelievably tight and GDP growth is positive, the market should not expect the Fed to cut the Fed funds rate.

The most persuasive argument for higher rates for longer is checking the three-month annualized core CPI which grew from 4.3% in December to 4.6% in January. If the rise continues, it would be a worrying trend even though Mr. Powell keeps propping the market up in each of his interviews (at least the market interprets his words bullishly). On the other hand, the market participants should consider that this is not the first time the three-month annualized core CPI grew since the start of 2022 market uncertainty. It happened two times over the course of last year, but the momentum is clear. Core CPI is trending down, but it is still well above the target rate. The market is aware of these inflation dynamics and thus the terminal rate peak grew from 4.80% to 5.25% over the course of two weeks. On top of this, soft landing and China reopening should not ease the job for the Fed officials, especially in the case of renewed energy inflation. Nevertheless, there is no reason for pessimism as more and more hikes are impacting the economy as time moves on. If we presume the time since inception to full effect on the economy of a year (some economists say it is closer to one and a half years), then most hikes haven’t even thoroughly impacted the economy.

We think that a soft landing in the US is not a far-fetched scenario which may mean higher rates for longer without recession in 2023 or 2024. Furthermore, higher rates may help the monetary policy in the future to escape the zero lower bound with whom it battled through the 2010s. One thing is for sure, the Fed won’t lower interest rates just by 25bps or 50 bps. It will lower them by at least 200 bps if the growth becomes significantly negative. For now, there is no reason to believe that would be the case for at least the first half of 2023.

Yesterday’s retail sales data further affirms the idea of evading the recession in the near term as retail sales came at 3.0% MoM compared to the market expectation of 2.0% MoM.

Source: Bloomberg, InterCapital