Back in the 1960s The Byrds issued an iconic single “Turn! Turn! Turn!“, repeating the biblical verse that there’s “a time to plant, a time to reap”. Speaking about planting, CEE countries have recognized that the right time to place international bonds is right about – now. And the right place is the USA. Why? And could Croatia be the one to place soon? Well – You’ll have to read this brief research piece to find out.

If You were forced to make investment decisions in the coming days based on just one number and one number alone, what would it be? We would opt for EURUSD (approx. 1.0820) because it currently compresses all of the transatlantic monetary policy divergences in a single number. With FED giving signals that peak interest rates are near, however, markets are slightly getting ahead of themselves and are starting to price in an end to American QT and interest rate cuts as well. To give credence to the statement that markets are expecting FED fund cuts as soon as this year, pay close attention to BBG WIRP US function pricing in cuts as soon as September:

That’s precisely what Blackrock Vice Chairman Philipp Hildebrand voiced in Davos this week – in a nutshell, easing expectations might be premature. Nevertheless, the bets are placed, the liquidity in credit is out there and anticipation of the end of a tight monetary policy motivated CEE countries such as Hungary, Romania, and Serbia to do USD placements early this year. It was the cheapest solution to get ample funding, with Romania even managing to finance half of this year’s gross funding needs with a single shoot: triple tranche (5Y/10Y/20Y) placed at spreads so tight (T+280bps / T+350bps / T+385bps) that even the respective Ministry of Finance was amazed.

One EM trader correctly pointed out that had they waited a couple of days more, they would get an even better deal – although picking the right timing is often ascribed to luck (or lack of it). But look at it this way: ROMANI 6.625 02/17/2028$ (the 5Y paper) was placed at 99.607 clean (6.71% YTM, T 3.875 12/31/2027$+280bps) and now it’s traded slightly above 103.00 clean (5.93% YTM, T 3.875 12/31/2027$+252bps) – notice the 28bps tighter spread.

We’re not just talking about our health, but instead would like to point out that Serbia will place 5Y/10Y USD paper today and that ROMANI 6.625 02/17/2028$ spread tightening might have played a big part in making this funding decision. Since there is no SERBIA$ curve, using comparable bonds as an anchor for a valuation we expect the SERBIA 5Y to be placed around 6.50% YTM (IPT T+330bps, around 6.70% YTM, implying some tightening would have to take place). Yes, we got our numbers straight because 50bps-60bps to ROMANI 6.625 02/17/2028$ looks like a fair valuation. Now, why is this 6.50% valuation so awkward? Well, take a look at SERBIA€ and You will see what we’re talking about:

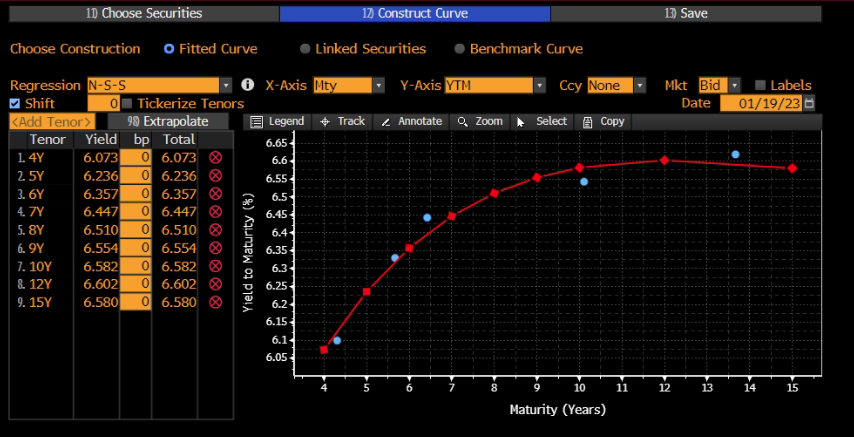

Notice that there is no SERBIA 2028€ and there’s a gap on that part of the curve, a simple N-S-S interpolation gives a € yield of roughly 6.236% YTM. Notice that this is only 26bps below the respective USD yield. Now, we bet that most of our readers are very well versed in FX/MM/FI and know quite well there’s no chance this quarter of a percentage point of extra yield in USD would cover for the FX hedging costs from the investor perspective (this is a USD paper and all of us have EUR B/S). But just to get the numbers straight: EURUSD Crncy FRD function gives us 1.1362 EURUSD mid on 5Y duration, which is roughly 1.00% interest rate differential – in plain English, that’s what You lose on the hedge and the synthetic SERBIA 2028€ should be at 5.50% YTM (= 6.50% expected – 1.00% annualized hedging cost) after hedge accounting takes place. If the deal really does go through, the Serbian Ministry of Finance would probably be amazed at their Romanian colleagues at how well the country performed overseas.

Recent placements of €Greece 10Y€ and BGARIA 4.5 01/27/2033€ were signals that the pipeline in euroland is working, but the deals are expensive relative to where USD would be. Nevertheless, Bulgaria managed to close a 1.5bn EUR deal (that was the maximum amount allowed by local law to be placed) on a 6.0bn EUR book (4.0x bid-to-cover) at MS+215bps. We were informed that some of the local clients had limit orders at MS+210bps (+20bps to the existing curve, if you could call that a curve), so MS+215bps was enough to keep them in. We see the paper traded at 99.50 (4.57% YTM) and with a 10Y EUR swap at roughly 2.60%, you can see that the secondary market wiped out all of the new issuance premium (NIP). There is the other side of the story here: a lot of local investors were afraid that the Ministry of Finance would go for the home run and place the maximum amount (which in the end materialized), meaning that the bond would suffer on the secondary market. However, NIP was ample and the bond got an unexpected boost from BoJ’s soon-to-leave head Haruhiko Kuroda sticking to his yield curve targeting and trading off the USDJPY exchange rate, causing bond markets to rally the following morning and local investors flocking into new paper hand over fist.

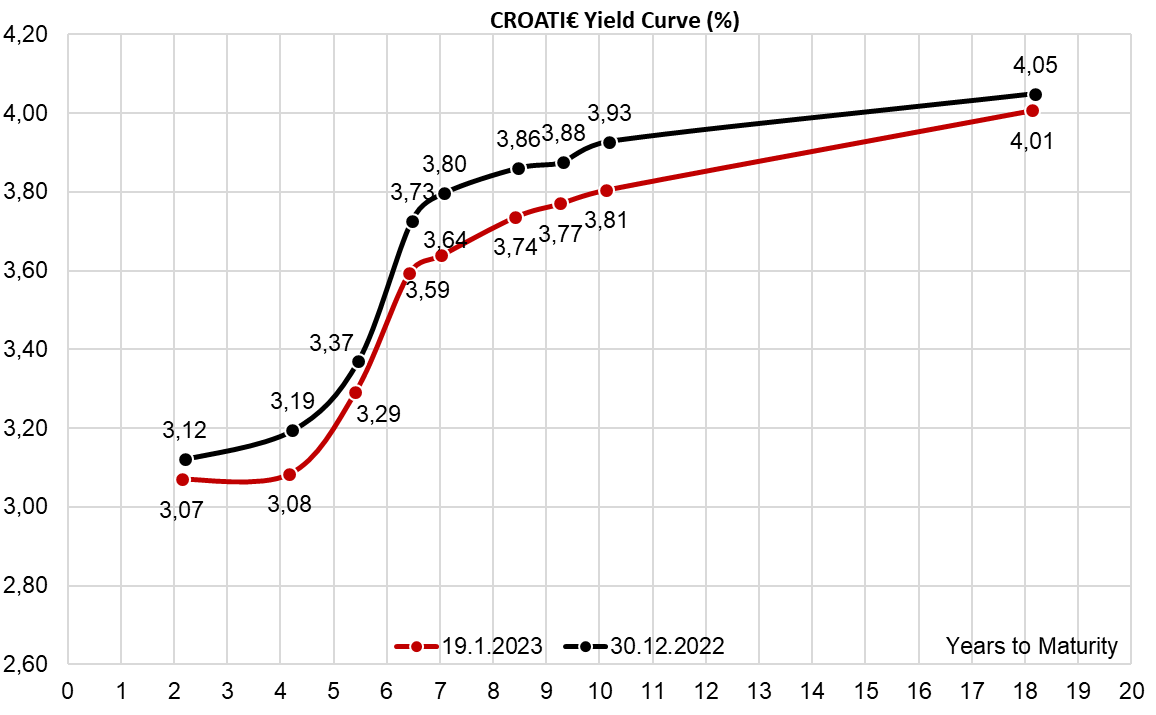

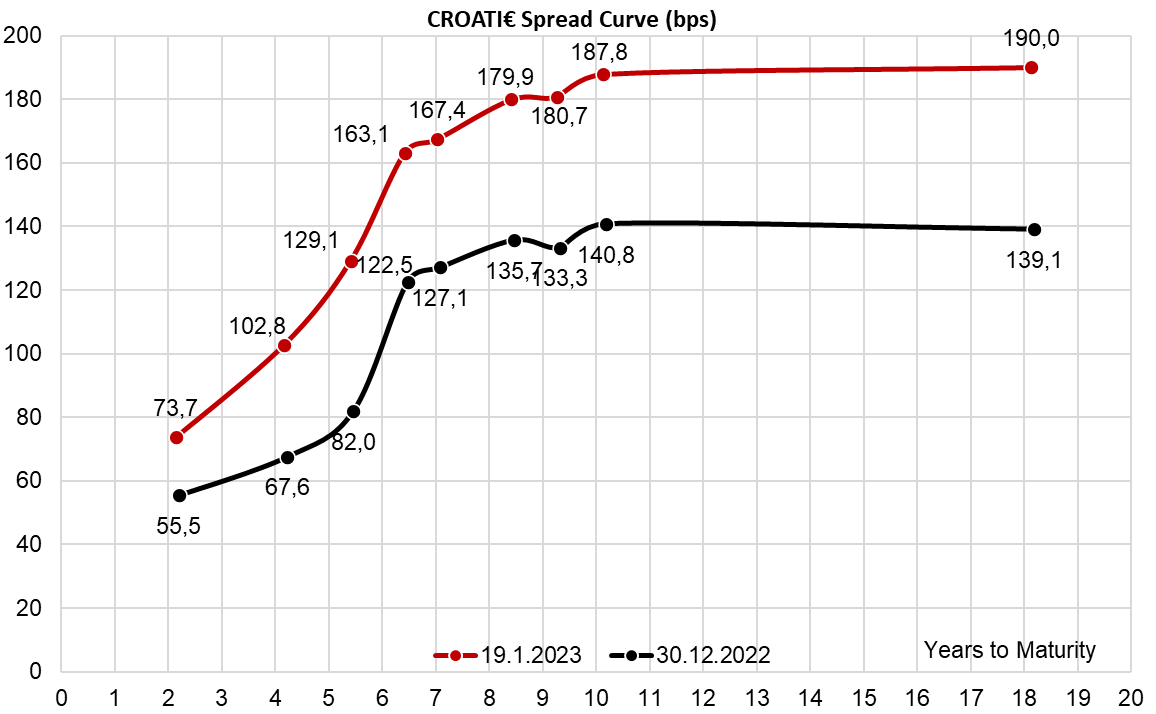

Would it be a good idea for Croatia to place a new paper on the international market any time soon? With gross funding needs at approx. 5.5bn EUR and 1.5bn EUR earmarked for international bonds, we can only say two things: cash is out there, and cash is cheaper overseas. Who doesn’t believe us should look at today’s SERBIA$ placement and just focus on the shorter maturity. Take a close look at where it would be placed and keep in mind that countries such as Slovenia also came out of the closet with announcements that the next placements would be either in USD or JPY (we put a low probability on “Alpine samurai”). If You glance at the CROATI€ yield and spread curves, you can see that the spreads are still a bit wider than where they should be, possibly because markets are in the anticipation of the international bond announcements in the future. Nevertheless, a lot of CEE countries are placing, so asset managers are putting their liquidity into new issues and pocketing in the NIP (as we described in the case of BGARIA 4.5 01/27/2033€).

If Hildebrand is right, markets will have to reckon with “higher for longer” scenario sometime throughout the year. That means VIX is significantly above 20.0, causing USD credit spreads to widen and liquidity to dry up. So maybe it would be a good time to take, when the market is giving. With this in mind, the flock of CEE/SEE countries already placed their international bonds this month, got their minds cleared of funding needs, and now only two birds are missing: Poland and Croatia. And Bloomberg tells us that we won’t have to wait for Poland to land. And yes, USD placement is expected. Of course.