Investing in ETFs has never been easier, more cost-effective, and less risky. If one is looking to invest in equity market but doesn’t want to pick a stock and invest with small amounts, ETFs are the best option. On the ZSE, there are three ETFs listed that are tracking Croatian, Slovenian and Romanian total return equity indices (7CRO, 7SLO and 7BET). We’ll explain all the benefits our ETF offers. Further, we’ll touch upon the newly listed IC money market ETF: 7CASH. Finally, let’s not forget about realized strong double-digit returns from ETFs: 7CRO offered as much as 34.3% YTD return! Further, 7BET offered a 26.2% return since listing (the beginning of June), while 7SLO increased more than 20% YTD!

As the year passed and is coming to an end, we decided to look at the performance of three equity ETFs ( the CROBEX10tr index and SBITOP tr index, and BETtr index with a ticker of 7CRO, 7SLO & 7BET, respectively). Basically, we’ll look at how ETFs performed compared to all of the constituents in the index itself and all the benefits this kind of instrument offers. Not only from the returns perspective, but also from the risk, and cost perspective. But before we get into the specific ETFs, we will emphasize the key benefits of owning an ETF:

- Diversification – the single biggest advantage of owning an ETF is the instant diversification you get just by owning “one” product, at the cost of only that specific single product

- Liquidity – ETF trades on the stock exchange and can be bought/sold throughout the trading day at market prices

- Transparency – Provide transparency into the assets they hold. You can usually see what’s in the ETF on a regular basis.

- Low cost – Typically have lower expense ratios compared to mutual funds.

- Tax benefits – Dividends that the ETFs receive are usually not taxed (or at taxed at lower rates).

7CRO, 7SLO & 7BET returns [YTD, %]

Source: Bloomberg, InterCapital Research

We emphasize that an investor buying IC 7BET ETF on its listing (this year at the beginning of June!) would also realize a strong double-digit return of 26.2% via exposure to the whole Romanian stock market by buying ETF itself. Also, 2023 YTD, 7SLO (SBITOP tr ETF) had a strong double-digit return of 20.4%! Finally, investors would yield as much as 34.3% from 7CRO ETF on a YTD basis!

However, besides the already mentioned fast-paced growth, Croatia, Slovenia & Romania are expected to grow faster than the EU average in the upcoming 2024. This is exactly why we think further development of our ETFs, representing the market as a whole, will continue in the same alley. As the estimates for Croatian GDP growth are above the EU average in 2023 and 2024, Croatia is expected to converge even closer to the EU average. Personal consumption will remain the main driver of economic growth in the following period. It will be supported by a strong employment rate, while unemployment stood at its record low rate of 5.8% in September this year. Due to the tightness of the Croatian labour market, we expect wage growth in 2024 to broadly keep pace with inflation. So, we expect personal consumption to remain robust and drive GDP growth.

Historical growth rates and expected FY 2024 growth rate

Source: Eurostat, European Commission Forecast

Let’s not forget that each of those three equity ETFs are on a total return basis. Therefore, dividends, that play an important part in our regional market, get reinvested in the ETF itself, resulting in optimal tax benefits. In other words, dividends are not paid out, thus the investor does not have to pay taxes on dividends. And to remind, Slovenian SBITOP at the current levels pays c. 6% in DY, while Romanian BET offers an investor also an attractive yield of more than 5%!

7SLO and each SBITOP constituent returns [YTD, %]

Source: Bloomberg, InterCapital Research

As can be seen from the graph above, the only heavyweight constituent with a double-digit weight in SBITOP, that outperformed the index itself is NLB. Before going further, we feel the urge to emphasize NLB’s strong performance this year. Firstly, NLB achieved solid loan growth of c.5% in 9M 2023, further boosted by higher NIM (+1.25 p.p.). Besides solid results, NLB updated its 2023 & 2025 outlook, offered a solid DY of 7.7% and finally, announced the acquisition of Summit Leasing – a leading provider of auto finance in Slovenia (in more detail here). But, let’s get back to the top. What we wanted to emphasize is that only NLB from all heavyweights managed to outperform the index itself. Each other constituent underperformed our ETF 7SLO. Besides the return perspective, by buying this ETF you would not only have achieved better results than if you were stock picking(unless you went all in on NLB 😊 ), but you would’ve automatically achieved solid diversification across all sectors that LJSE offers. From the risk perspective, let’s just remind about Slovenian insurers and their high CAT claims during Q3 and profit warnings issued from insurers due to regulation on Supplementary Health Insurance. Further, Petrol also witnessed unexpected recent regulation in the form of the Slovenian government cutting fuel margins (in the context of lower inflation!). ETF is an instrument that offers an answer to all the risks tied to a specific company/industry, while still offering the return of the market as a whole!

Now, after we talked about this year’s return and risks, let’s talk about other specifications of an ETF. You can buy it directly on ZSE over a broker just like any other listed stock. So you can achieve the aforementioned diversified portfolio as easily as it gets. The alternative would be buying all the stock from the index and weighing them accordingly to get exposure to, for example, CROBEX10. The price of the fund’s share already includes a management fee , which amounts to just below 1% for all three equity ETFs. This is a gruesome and lengthy process that entails also broker fees for each additional stock. But when you buy ETF you can at any point in time see what’s in inside our ETFs and how much it is valued as a whole. And finally, fees are considerably lower than in scenarios when you are buying each security individually.

Source: InterCapital Asset Management

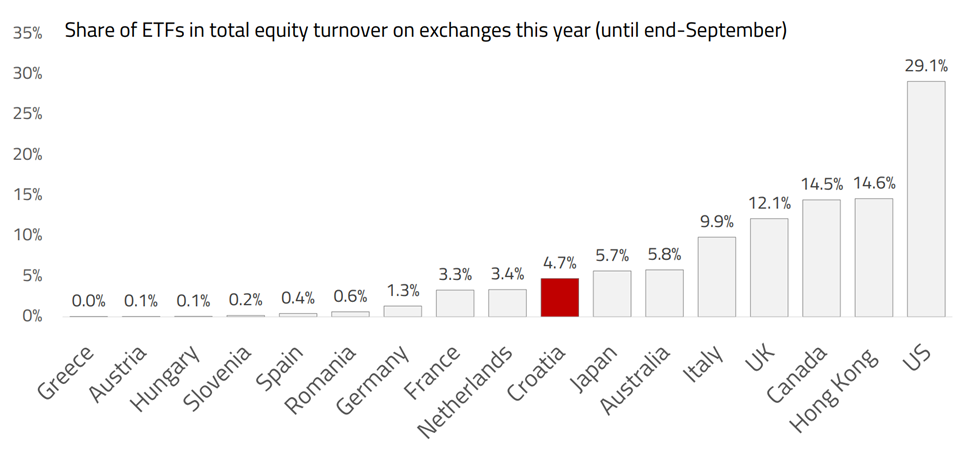

As can be seen from the chart above, the US recognized ETFs advantage already with almost 1/3 of total equity turnover on the stock exchange being accountable to ETFs. Europe is lagging, but when we look at previous years we can see a positive trend unquestionably being here. In Croatia, ETF account for c.5% of total equity turnover.

Finally, InterCapital Asset Management recently launched its latest ETF – Euro Money Market with a 7CASH ticker on ZSE. Money market ETF became very popular in the last three years due to their liquidity advantage. Those kinds of ETFs have lower management costs compared to other classic funds, they are very liquid and transparent. Finally, in the environment of higher interest rates (both from Fed & ECB) they offer attractive yields with a 7CASH expected return of c. 3.65% per annum. The closest instrument for comparison would be a government bond issued by the Republic of Croatia. However, 7CASH will invest in securities that have a better credit rating than the Croatian government bond. 7CASH is currently composed of debt instruments issued by AA & AAA issuers app. and other money market instruments. Currently app. 72% is invested in Treasuries issued by France, Belgium, Germany and the Netherlands, while the rest is invested in money market instruments or reverse repurchase agreements of bonds. Finally, until the end of the year, investors can buy 7CASH without a broker fee and management fee that will from the beginning of 2024 be charged at 0.15% annually.