Year to date the fixed income dynamics resembled a struggle between investors skeptic about global growth (fixed income bulls) and investors skeptic about inflation being under control (fixed income bears, or vigilantes). At least a dozen latest trading sessions were dominated by fixed-income bears and the question on the table is – what gave them the reason to go wild in such a way? A short answer is INFLATION, however, what matters most is how long is the bear party going to last and what might kick off the next leg up. Find the long answer in this brief research piece.

Most recent trading sessions have been marked by a change in the underlying inflation trend in the US, as well as a change in FOMC’s reaction function to hard economic data. It all started on April 05th with strong NFP print (+303k versus +214k consensus), which was however accompanied by unemployment and average hourly earnings arriving straight on the spot of market consensus (3.8% and 4.1% YoY). A brief glance under the hood of the spectacular rise in US employment reveals that close to a half of +303k mentioned came from healthcare and social assistance (+80k) and government employment. Speaking about the former, the sector is still about 1mm jobs short of it’s old trend, which accounts not just for the pandemic losses, but also for higher demand due to population aging. Nevertheless, US10Y futures sold off on the headline print, however, pared almost all of the losses in the next few trading sessions.

The US CPI print on April 10th was the straw that broke that camel’s back and the true reason why the bonds sold off. January and February prints also came to a thad above consensus, however, they were discarded by FED observers and deemed as seasonal quirks – so essentially all noise, no signal. The third consecutive consensus beat meant only one thing – the trend might have been changing. So far the FED officials have been quite optimistic about inflation reaching its target 2% without causing an economic slowdown, creating a hype about cutting rates this year which propelled equities, credit and corporate bonds. Nevertheless, the two days in April brought this narrative into question and postponed rate cuts further into the future. This Wednesday (April 17th) FED Chairman Jerome Powell confirmed what the markets were already expecting and pricing in swap curves: “Right now, given the strength of the labour market and progress on inflation so far, it’s appropriate to allow restrictive policy further time to work.”

So what happens next? Markets were getting ahead of themselves by expecting rate cuts early and in almost irrational magnitude and these expectations are now dialed back. Nevertheless, we couldn’t help to notice that the recent shift of the yield curve could be compared to additional tightening, vouching for no more FED activity past rhetorical assistance given to this point. FED doesn’t need to walk the walk, it only needs to talk the talk and swap curves are going to do all the tightening. It might take time before this is felt on US CPI data. However, take a look at market expectations of incoming rate cuts:

What the FED fund futures are telling us is no cut in June, a 50% chance of a cut in July and maybe one more cut in December. Given the recent tightening of the financial conditions happening through yield curves shifting north on hard data exceeding consensus and FED speak confirming a narrative shift, we do believe that the markets might be ahead of themselves one more time.

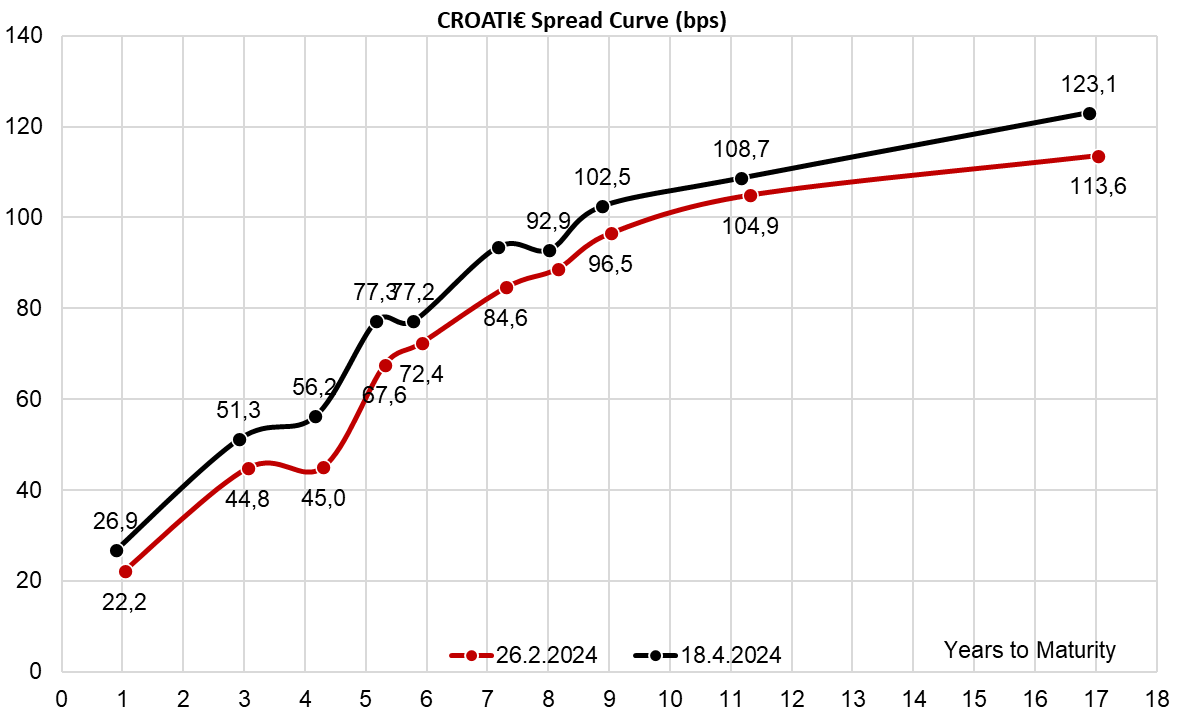

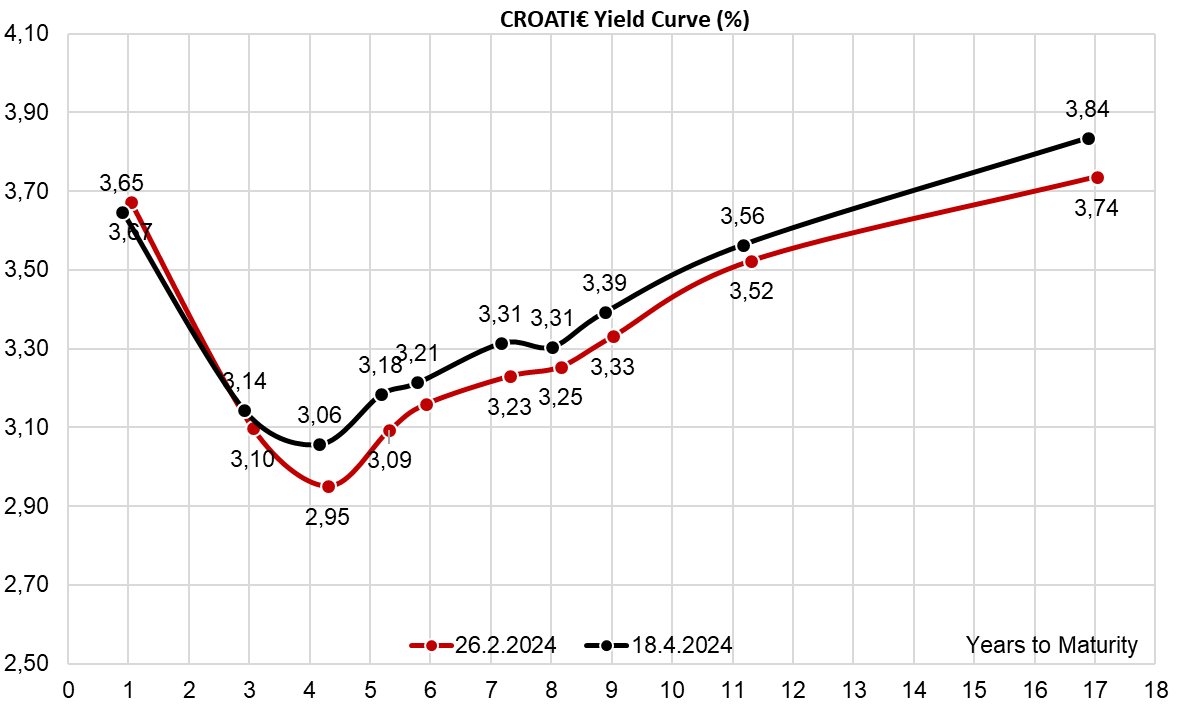

How are Croatian bonds faring? Yields naturally went up, but spreads are still well-behaved. It’s worth bearing in mind that a good chunk of the recent bond sell-off was reversed yesterday evening with a solid US 20Y placement. Correlations with Germany are much stronger than a couple of years ago, a direct consequence of euro area entry, however, this also means that bonds can rally only if Germany rallies as well. Will have to wait for more clarity on that.