Mission accomplished for the ECB? Only time would tell, but we would like to point out that Madame Lagarde was as adamant as possible to avoid any pretense of commitment to peak rates and committed only to data dependence. What happens next? Find out in this brief research piece.

In line with market expectations, the Governing Council of the ECB raised the three key interest rates by 25bps, setting the deposit facility rate at 4.00% (an all-time high).

What makes this a dovish hike? First of all, GDP forecasts have come down a bit: 0.7% (from 0.9%) in 2023, 1.0% (from 1.5%) in 2024 and 1.5% (from 1.6%) in 2025. Inflation forecasts have gone up, as foretold in part by a Reuters leak a few days earlier: 5.6% (from 5.4%) in 2023, 3.2% (from 3.0%) in 2024 and 3.1% (from 2.2%) in 2025 – this is indeed hawkish and coupled with sluggish GDP growth constitutes a stagflation scenario. Moreover, ECB staff now forecasts EA GDP growth of 0.0% in Q3 and 0.1% in Q4, awfully close to recession.

Nevertheless, one of two sentences stands out in the statement that makes it a true dovish hike: “Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to target. The Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary.” There’s a lot to unpack here – the first sentence effectively implies that we have reached peak rates, however, ECB officials have always had a problem with commitment; hence the wording includes enough moving parts to make it easier to switch back to full “data dependence” without losing credibility. During the Q&A session, Madame Lagarde was decisively ambiguous, stressing that same “data dependence” and adding that balance sheet operations (PEPP+APP) were not discussed, that there is no numerical value clarifying the meaning of “sufficiently long” and finally that some of the GC members preferred keeping the rate on hold. Some is more than a few. Perhaps this is indeed peak rates and now we have entered a new phase of the battle against inflation where it becomes crucial to determine high for how long?

In addition, there are plenty more dovish elements in the statement: a slowdown in China has been added to the list of factors contributing to the fall of inflation. Labor market is now “resilient” versus “robust”, while economic growth is “subdued” instead of “has deteriorated”.

Lagarde said during the Q&A session that the monetary-policy setting team “can’t say that now we are at peak”. FX markets didn’t take it seriously and EURUSD dropped by 100 pips to about 1.0640. EGBs rallied, EMS such as newly placed ROMANI 6.375 09/18/2023€ caught a bid and managed to trade some 100 cents above the reoffer (100.20 rf versus 99.19 rf), while BTP-Bund spread tightened by some 5bps to 175bps. Longer-dated CROATIs are traded on autopilot at B+150bps/B+140bps and participated in the bond rally that was eventually curbed by US retail sales and PPI data.

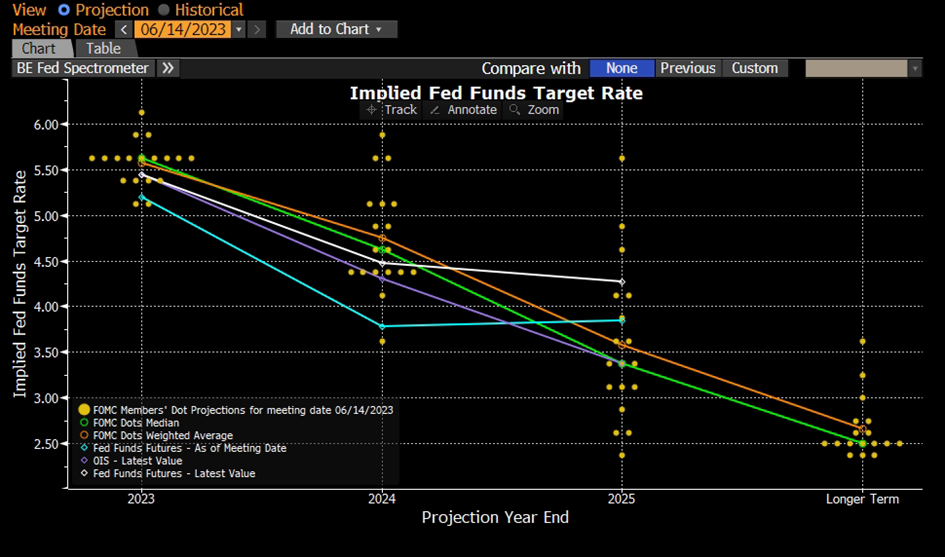

What do we think about the fixed income complex in the current environment? Well, first of all, the autumn European inflation data is probably going to come higher compared to late spring/early summer because of the higher energy prices and higher service costs (tourism in Southern EU countries contributes a lot to this phenomenon). Additionally, the focus now switches to the next weeks’ FOMC, which is a lot more interesting. Don’t forget that in June forecasts FOMC came forward with dots report expecting the median 2023 dot at 5.625%, which is still a one rate hike away from the current 5.25%-5.50% target band.

So what do we do with this piece of information? Well, if you’ve been reading pieces in WSJ written by Nick Timiraos, then you’ve probably been vaccinated against placing too much importance on FED dots and instead focus on the main debates and narratives within the committee. In his latest (master)piece published in the September 11th print version of WSJ, Timiraos pointed out that the committee is divided regarding that last hike, stating that “For the past year, officials have placed the burden on evidence of a slowing economy to justify pausing rate increases. As inflation cools, the burden has shifted toward evidence of an accelerating economy to justify higher rates.” This statement was further supported and substantiated by FOMC skipping one rate hike, a move justified by the need to take some time off and reflect. The question seeking an answer next week is whether cooling inflation and a less vibrant jobs market found their way into two of three macroeconomic models independently used by FOMC members, which would be enough to cut that last hike telegraphed in the DOTS report of 14th June.