On the first trading session in February futures markets were expecting a rate cut in the US by June this year. However, as fears faded this date has been moved further into the future and now with economic conditions slightly improving, the date might be completely moved out of the 2020 calendar. Where are the pockets of value in these circumstances? Find out in this brief research piece?

Although coronavirus (2019-nCoV) pandemic doesn’t seem to abate, US equity markets have shrugged off most of the risk off sentiment and the Wall Street bull is running freely once again. A popular Wall Street rule of thumb tells us that in times of a pandemic markets usually start to turn once the number of new cases peaks, but this time around it’s been completely different because of other forces in the environment. Namely, this morning during the Asian session a news bite crossed the wires about China being prepared to halve the tariffs on 75bio USD of US imports starting from February 14th (that’s why it was dubbed “an early Valentine’s Day gift”). This is clearly sign of goodwill, possibly trying to court US administration into a similar line of action, which would curb at least part of the slowdown fears caused by quarantine in Wuhan.

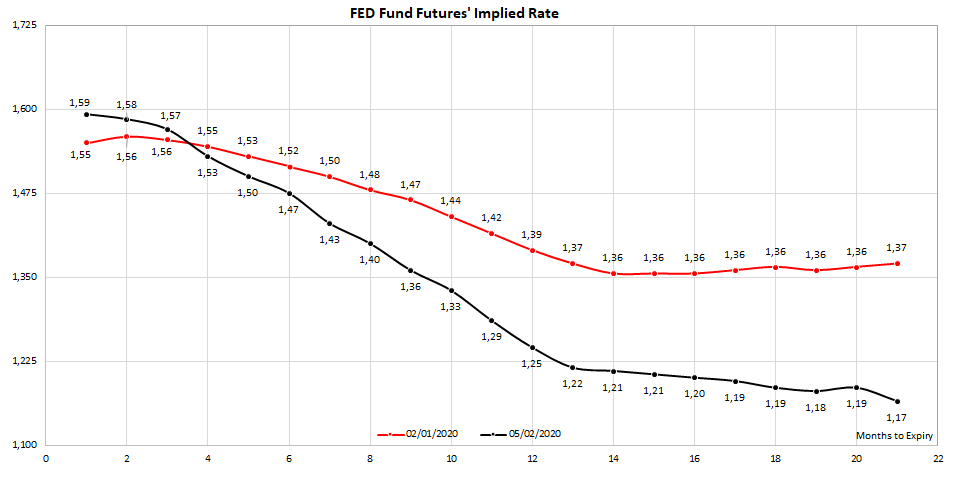

Shifting our focus on global bonds, the sentiment has changed compared to the very beginning of the year, as indicated by two charts submitted below. Looking at the FED fund futures, financial markets were expecting a rate cut in late summer of this year – believe it or not, it was completely at odds with the FOMC dots report, but then again some analysts consider the report to be misleading and backward looking altogether. By yesterday, the rate cut date has been moved to early summer, although positive news flow causes this date to move further in the future as no rate cuts would be needed to sustain the expansion of an economy that’s humming pretty good on its’ own.

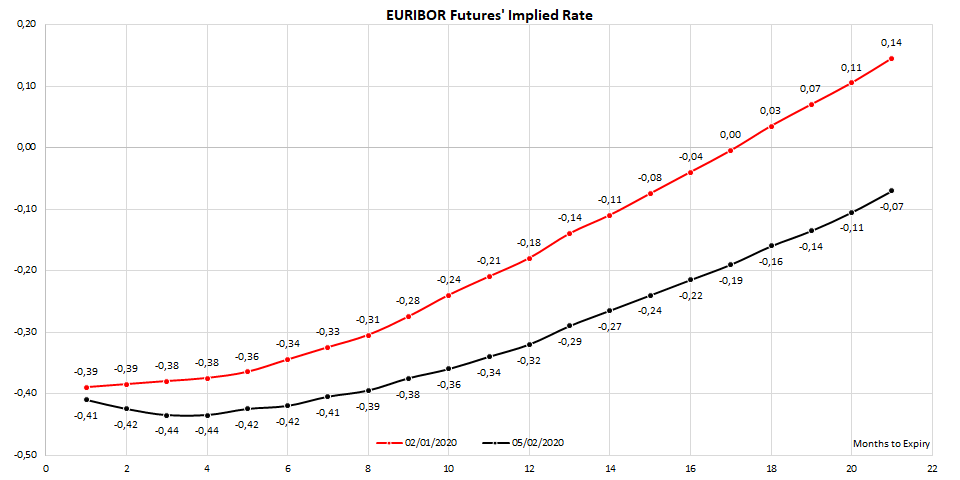

Speaking about economic indicators in the US, composite January PMI has been revised slightly higher to 53.3 (from 53.1 in a flash estimate), benefited mostly from a revision in Services PMI. The wording of the report painted a bleak picture – PMI growth was fostered by a low base in autumn (a point when trade wars reached it’s high noon) and we are in the election year which is often marked by lower spending; coronavirus outbreak doesn’t help either. Eurozone PMIs were also revised higher (to 51.3 from 50.9), but this was thanks to higher manufacturing PMIs (services ticked slightly lower). On the other hand, German factory orders released this morning dropped to -8.7% YoY (versus analyst consensus at -6.7% YoY), meaning that the worst might not be over for manufacturers in the largest European economy. Interestingly, the EURIBOR futures curve implies that no rate cuts under way in Europe, which is completely in line with economic theory since short term interest rates as low as they are now can’t do much to spur economic growth.

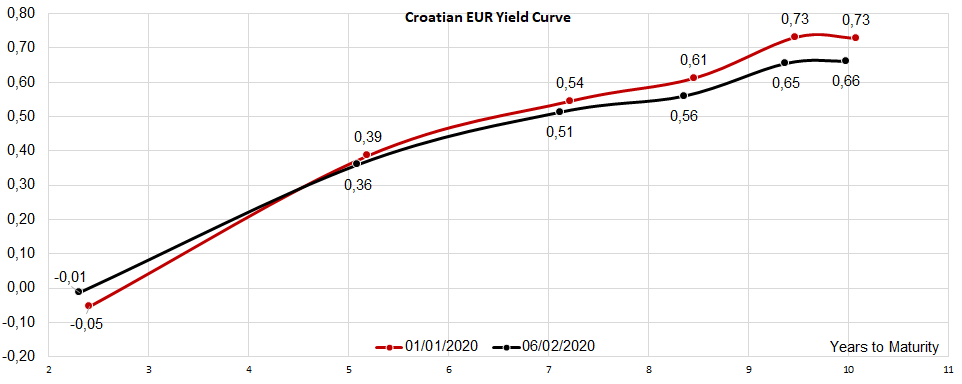

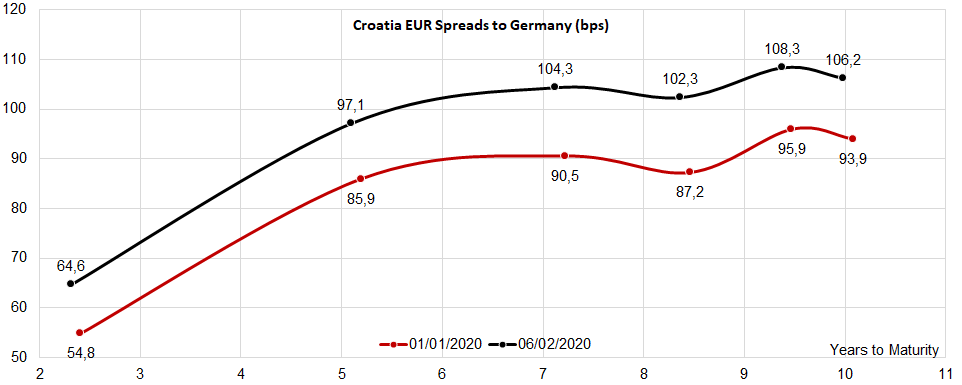

How are Croatian international bonds faring? Looking at the EUR-denominated ones, the drop in yields has not been congruent to the drop in German yields, meaning that the risk premium has widened (as indicated on one of the charts submitted below). For instance, CROATIA 2029 EUR is currently traded at 104.30 (0.65% YTM, Germany+108.3bps), meaning that the risk premium is in the 50th percentile in the three month time horizon – i.e. nothing exceptional.

It’s worth mentioning that CROATE 2⅜ 07/09/29 (the HRK-denominated 2029 maturity) could be purchased at 116.60 (0.56%) on the stock exchange, which is 10bps less off in terms of yield, but allows the investors to increase HRK exposure. Going long on HRK might not be such a bad idea because the EURHRK exchange rate might have entered doldrums in the midst of the pending Supreme Court decision on the conversion of CHF loans. The decision should be made by March 11th (90 days after the Court in Pazin requested legal opinion) and would involve the overpaid interest on former CHF-loans. If the fears of market participants turn to be overblown, the seasonal appreciation of HRK might offer attractive returns on an unhedged CROATE 2⅜ 07/09/29 because in the end, it’s the total return that the investors are after.