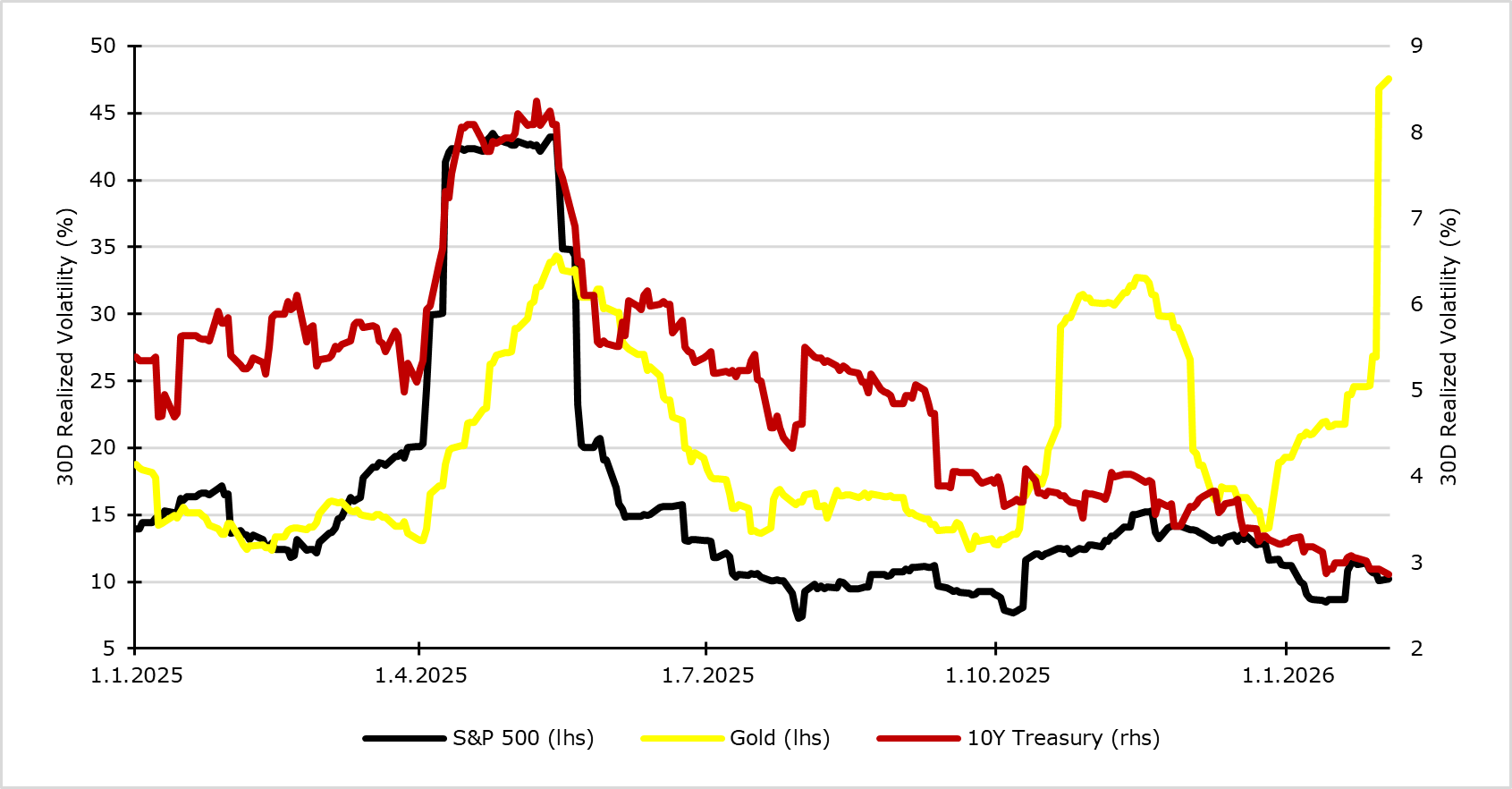

As monetary policy in the Eurozone and the United States has delivered most of the rate cuts that they have projected, and the economy stabilized after two years of episodes of extreme panic over potential recession, realized volatility on fixed income collapsed both in the US and the Eurozone markets.

This compression is clearly visible in options markets. Implied volatility on 10-year German Bund options has retreated to the lower end of the range observed during the 2010s – despite today’s materially higher level of interest rates. One-month implied volatility on Bund options is now below 4, with only a marginal uptick following President Trump’s threat of tariffs against Europe over Greenland. Even then, the reaction in European bond markets was muted. Equity markets sold off on headlines referencing a potential 10% tariff on the European Union and even the prospect of a military takeover of Greenland, yet fixed income traders barely flinched. In hindsight, the notion of a military takeover of Greenland appears entirely irrational, and bond markets treated it as such. More broadly, markets have shown remarkable indifference to a long list of geopolitical and political risks: the alleged kidnapping of Nicolás Maduro, threats of military action against Iran, US government shutdowns, and tariff threats aimed at Europe, South Korea, and Canada. Risk premia simply refuse to reprice. The 25-delta skew between puts and calls reflects a classic “boy who cried wolf” dynamic. However, this complacency may leave markets under-hedged should a genuine black-swan event materialize – or if President Trump ultimately follows through and escalates the policies he threatens. The experience of “Liberation Day” serves as a useful reminder. Markets failed to anticipate the magnitude of tariff hikes, and the S&P 500 sold off sharply before Trump ultimately reversed course. In the current regime, equities and fixed income are behaving unusually similarly, with bonds no longer providing the diversification or hedging properties investors have historically relied upon.

On the other hand, metals behave like crypto as realized volatility exploded both on upside and downside moves, especially on last Thursday and Friday. Such high volatility certainly won’t last long and needs to collapse sooner or later, as history proves that it is not sustainable. Retail market driving silver through options and SLV, resulting in very high implied volatility on options, isn’t sustainable, as theta on those calls is extremely high with call skew, which is a historical outlier. The problem lies in the lack of ability to short such markets (eg. Gamestop retail mania). The trend is so strong that no one wants to do it outright with delta 1 exposure and unlimited risk. Buying puts won’t deliver any return as implied volatility is positively correlated with spot price, thus resulting in a small or no change in put option value in case of a price drop. Other ways are mostly through put spreads or selling calendar spreads; however, with such positions, gains are mostly limited.

Friday’s selloff in metals, led decisively by silver, may ultimately prove to be a historic inflection point. Just days earlier, I joked with a colleague about overhearing conversations at a bus stop centered on the “silver bull market.” While we laughed at the time, that anecdote turned out to be telling. The prolonged suppression of realized volatility across traditional asset classes pushed speculative activity into commodities, generating extreme and unusual price behavior. That phase now appears to be ending – bringing with it a brutal conclusion for late-cycle speculators.

30 Day Realized Volatility

Source: Bloomberg, InterCapital