With holiday season passing in a flash, as always of course, we have had quite a start to the year. Last week, markets seemed largely unfazed with the events unfolding in Venezuela, where the US carried out an operation to extract and capture Nicolas Maduro.

Although condemning the operation, Russia and China stayed surprisingly quiet on the matter and geopolitical tensions remain elevated with the US’s successive captures of oil tankers from the Russian shadow fleet originating from Venezuela. President Trump also reiterated his ambitions to secure and protect the influence the US has in its hemisphere, as outlined in the new National Security Strategy. Some of the critical territory includes, among other, Greenland, which was already a sensitive and tense topic of discussion between the US and its European allies in 2025. Eyes are now also on Iran, where continued protest escalations are putting pressure on the ruling government, with President Trump saying he is exploring “options” for intervention.

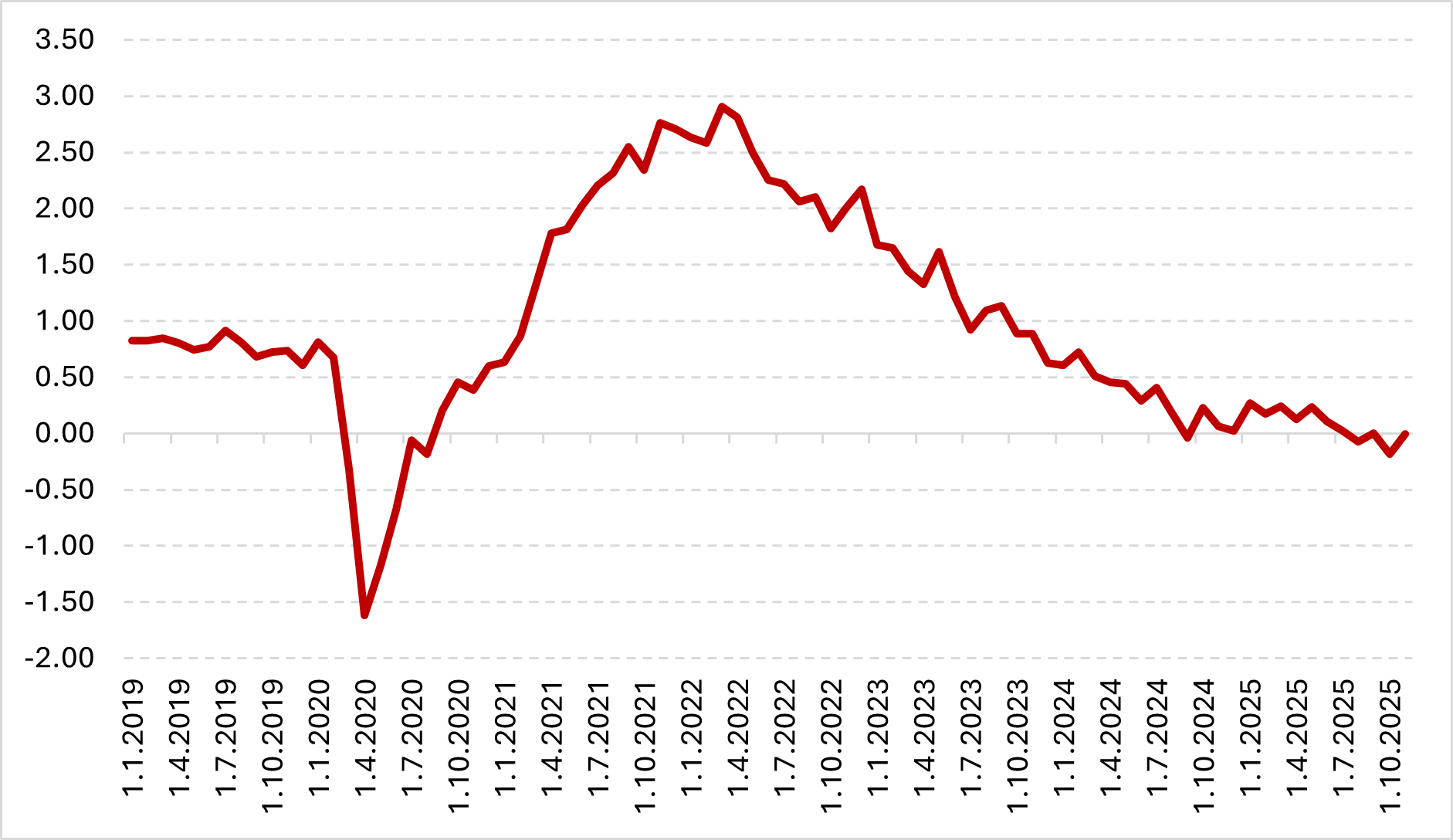

With all of this in mind, we will now turn to last week’s labor data, as we are starting to get a much clearer picture of what the Fed might do on its next meeting at the end of January. Unemployment edged down to 4.4% and the NFP mildly undershot expectations with economy adding 50K jobs in December, while the previous number was revised from 64K to 56K. Another interesting datapoint to look at is the Labour Market Tightness Index shown in the figure below.

HPW Labor Market Tightness Index

Source: Federal Reserve Bank of New York, Bureau of Labor Statistics, Job Openings and Labor Turnover Survey (JOLTS) and Employment Cost Index (ECI); Davis, Faberman, and Haltiwanger (2012); Barnichon (2010).

What does the index tell us? It is an indicator of labor market tightness, based on the quits rate and job vacancies per searcher, indicating current wage pressures. According to the data, there was a continued trend of labor market deterioration, and in November (which is the last datapoint) the labor market seems to be “nearly in balance”.

After the data releases last week, the Fed cut pricing did not change markedly, but only reaffirmed the expected, that the Fed is likely to hold the rates steady. CPI numbers which are due this week can still shake things up, but the market consensus signals there will be no marked changes to inflation. The market currently prices a 95% probability of a hold in rates while there still exists a 5% probability of a cut.

The bond markets shrugged off the labor data last week and mostly continued to tread flat on Friday without any abrupt swings. As of this writing, the 10Y US Treasury sits around the 4.197% mark while the German Bund trades around 2.82% in yield terms. On Friday, the S&P 500 extended further gains closing +0.65%, while the NASDAQ Composite closed +0.81% for the day. In Europe the DAX closed at +0.53%, and Euro Stoxx 50 extended by +1.58% for the day.

As already mentioned, in the US, CPI numbers are due to come out on Tuesday 13th, followed by PPI and Retail Sales on Wednesday. On Thursday we will be getting the S&P Global Manufacturing PMI’s along with Initial Jobless Claims number which will shed a bit more light on the current conditions of the labor market. In Europe, UK GDP numbers are due on Thursday, followed by the revision of German CPI on Friday.