As the FOMC prepares to gather for its upcoming meeting, the odds appear high that they will follow through with a 25-basis point cut to the Fed Funds Rate on Wednesday, October 29. Policymakers are operating somewhat in the dark, with only the CPI numbers for September being published in October due to the ongoing government shutdown. Stay with us as we explore our views on the economic backdrop of a looming rate cut, the impact of the government shutdown, the political context, and how these factors affect the shorter part of the US yield curve.

Inflation numbers for September were released because they are required for Social Security cost-of-living adjustment purposes and have thus been an exception in an otherwise dry month for official data releases. They arrived a tad below expectations but still running above target with headline CPI rising 3.0% YoY, up from 2.9% in August. For the Fed, this provides some latitude to go ahead with a rate cut while signalling the need for vigilance. However, the stubbornness of the inflation hovering around 3% leaves them above their long-run comfort zone, which will likely lead to increased caution in the upcoming months.

The backdrop to all of this is the ongoing federal government shutdown, which is now the second-longest on record, with a significantly large probability of becoming the longest. It has multiple implications with the quintessential one being 800k of federal workers furloughed or working without pay putting strain on consumer spending. Some sources even estimate that the toll could rise to $15bn per week if the shutdown were to persist. For the Fed and the market, it means that the collection of stats needed for the issuance of key economic releases like the unemployment data are delayed or paused altogether, introducing non-trivial uncertainty into their policymaking decisions.

In a recent speech, Chair Powell elaborated on the balance sheet and indicated that the Fed is nearing the end of QT or a least a transition phase, which the market interpreted as meaning that they will ease the pace of balance sheet shrinkage much sooner than was previously thought. Some voices were even proposing that it might happen this week. It would mean an added form of easing, and market participants will keenly watch guidance as it directly affects the long-term rates.

The equity market went into a short-lasting state of shock as President Trump, on October 10, announced the possibility of new tariffs on China coming into play. Just a couple of days later, he changed his mind, saying that the Trump-Xi meeting is still in play and TACOed on the tariff front. It took the market some time, but the S&P once again broke an all-time high and once again stopped caring for Trump’s Truth Social posts (like the one connected to Canada). Lo and behold, the Trump-Putin meeting in Budapest was cancelled, and Mr. Trump has sharpened his stance on Russia, implementing new sanctions on their state-owned oil companies, which gave oil prices a slight push from the local bottom of $57/bbl.

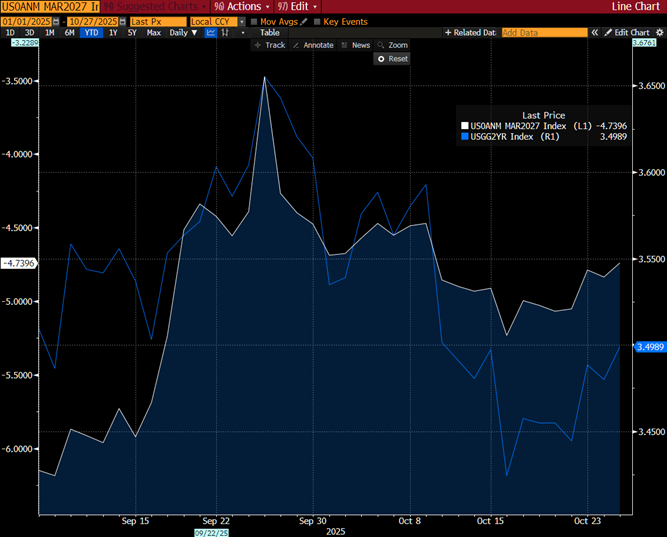

To surmise, with the political & trade context providing new information the short-term volatility is likely to persist. However, without the impetus from confirmations of a slowdown in the labor market, the US short-end of the curve, namely the 2-year, is unlikely to gain further ground.

US 2-year yield and terminal rate number of cuts

Source: Bloomberg, InterCapital