After several weeks in low realized volatility environment, US and Chinese administrations rattled the animal spirits of financial markets once again with brand new trade tensions. With Japanese financial markets closed for the day, could we expect more to come? Find out in this brief research piece.

He’s done it again, hasn’t he? Well this time, it really wasn’t Trump who picked up the fight.

On October 09th Chinese administration announced that it would add five more rare earth elements to the export restriction list, resulting in twelve out of seventeen rare earth elements facing export licenses. Furthermore, Chinese companies that try to export technologies needed for smelting, mining and processing rare earth elements would also require export licenses. This spelled an end of the durable déténte in trans-Pacific trade relations, especially after Trump’s administration announced that US “will impose a 100% tariff on China, over and above any tariff they are currently paying“ by November 01st. We find rater interesting that Chinese export curb on the rare earth elements brough drew very little market attention, comparative to US reaction on Friday that effectively returned EURUSD above 1.16, SPX below 6.600 and 10Y within striking distance of 4.00%.

Still, the elephant in the room is clearly US government shutdown that began on October 01st and shows no signs of easing any time soon. For the time being it looks as if it will probably last 8-10 weeks since no political party would gamble the outcome of 2026 mid terms on the public perception of US spending freeze.

Here’s one more thing to think about. Since government shutdown started on October 01st, September payroll data that was supposed to be published on October 03rd is still pending and disclosure date is unknown for now. The thing is, September 30th was the last day in office for some 100k (out of 154k in total) federal employees that took deferred resignation program. Are they expected to show up in the September payroll data? Well, Office of the Personnel Management (OPM) announced that some 60k retirement applications are currently in the system (link), meaning that most of these federal employees took this as an opportunity to retire early.

How would this affect the NFP once it gets published? The most likely outcome is headline figure down (but not by 100k), unemployment slightly up and wage growth slightly slower. Labour force participation rate would dip the most, but nobody really pays close attention to this figure since it tends to get overlooked by FOMC. However, all of this is relatively unlikely to affect the October 29th FOMC decision since it’s quite likely that government shutdown would extend past the meeting date.

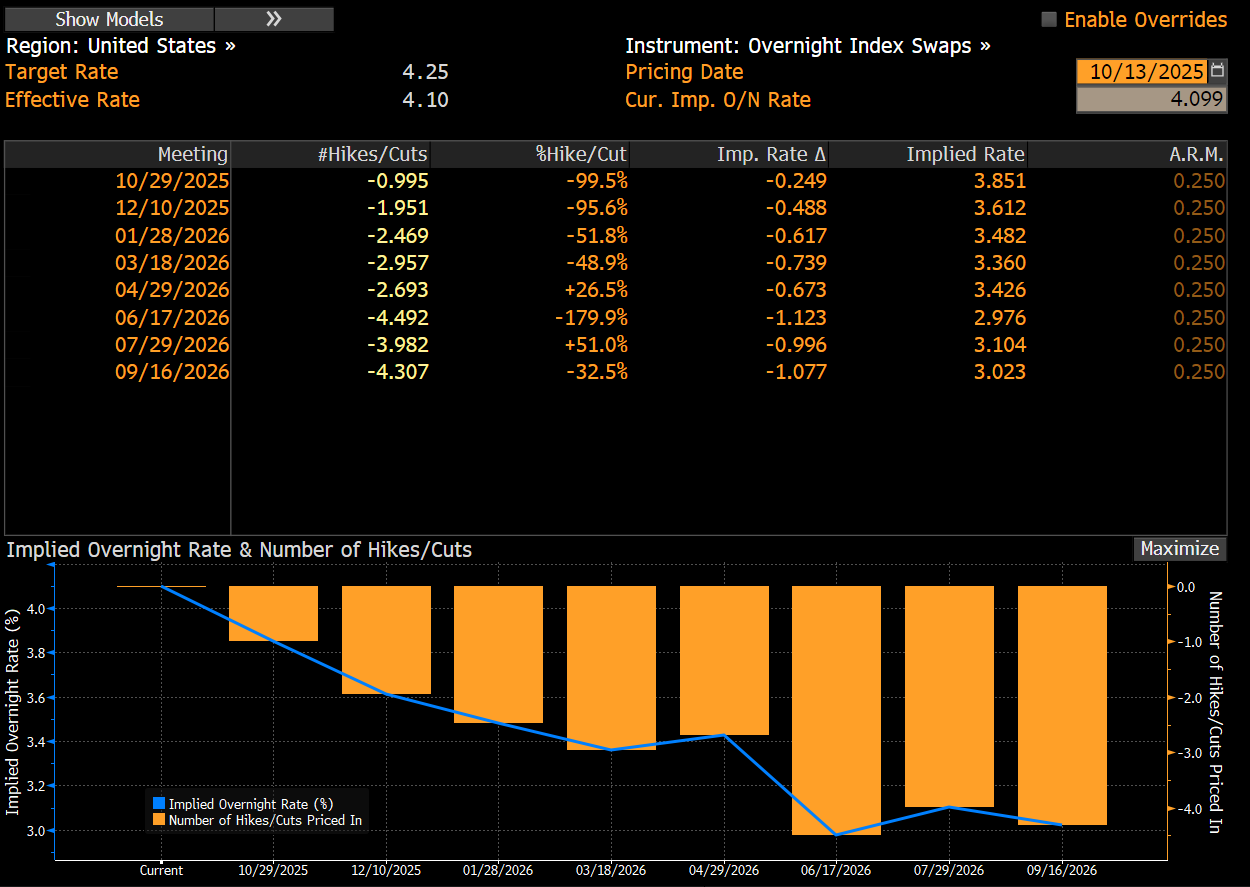

So what do we make of October FOMC in the wake of October “macro blackout”? FED’s monetary policy setting committee would probably deliver one rate cut as expected since it was telegraphed already and set the target range to 3.75%-4.00%. The real deal is what happens in December (December 10th, to be more precise). First of all, trade war reescalation is definitely going to slow down growth and it’s going to become very visible in high frequency macro data. Second of all, notice that Chinese side didn’t respond to Trump’s tariff threat, not even with a brief note on back peddling of additional rare earth restrictions. It’s possible this move might come in the days ahead, but if it doesn’t, we might have a hot November on our hands.

What does all of that mean for fixed income? Since now the trade ball is in Chinese court and equities didn’t stage a major sell off in the wake of reescalation, we see very little upside for core yields. Actually, it’s quite likely that yields might dip below 4.00% as November gets closer and closer. Even if Congress stalemate is passed by Thanksgiving (this is our base scenario), irrational curbs on migration (such as recent incident at Hyundai factory and H1-B visas) are quite likely to keep the headline NFP figure subdued. The thing with the NFP is, FED is watching it as an indicator of strength/weakness of the labour market and if wages are still growing at a lofty pace (and by lofty we mean anything better than in pre-COVID), they won’t interpret weak headline figure as a signal to cut faster. Now here’s the fun part. FFF6 (Jan 26 FED fund future, maturing on January 30th 2026, i.e. after January 28th FOMC meeting) is trading at 96.38, implying effective FED fund rate at 3.62% (3.50%-3.75% target range). This makes up for two additional cuts by year end and then a pause in January. We believe this to be quite unlikely due to prolonged shutdown, re-escalating trade tensions that set the stage for indefinite tariff postponements and pending cuts to the federal labour force. With FED increasingly sensitive to labour market weakness, a third cut in the coming three meetings would be warranted. With 5Y5Y inflation breakevens cooling off, this might set the stage for permanent dip of US 10Y below 4.00%, moving the German 10Y closer to 2.50%.

What does all of this mean for Croatian end CEE/SEE international bonds? With transatlantic trade deal signed and sealed, realized volatility is gradually evaporating from European fixed income markets making shorting front month straddles probably the best trade since May. Amendments to the German constitution accommodating more government spending in March and Liberation Day madness in April increased implied volatility across the board, but since May this has been gradually sliding down. We expect EU yields to continue drifting lower, enjoying a pull from their US counterparts. Naturally, the spreads have little room to tighten even more as they are already drifting at their multiyear nadirs. That being said, we see CROATI 4 06/14/2035€ at B+25bps-45bps with very little chance for excursions above the range.