The backdrop of deteriorating US fiscal situation, increasing pile of government debt concentrated in the short end of the curve (introducing significant rollover risk) and expanding deficits, incurred serious concerns about fiscal responsibility and sustainability. There has been a lot of criticism due to the increasing share (>13% of the total FY 2024) of interest expenses in the overall government budget, whereas the current US administration deems to be addressing these issues.

Building on the Strategic Bitcoin Reserve (SBR) EO from March 6th, one of the ideas was developed in the Bitcoin Policy Institute in April (BPI) by Andrew Hohns PhD and Matthew Pines ED, later formalized and proposed by VanEck to the US Government, referring to Bitcoin-Enhanced Treasury Bonds (BitBonds) as a case for lowering US 10Y yield through lower debt burden and increased demand.

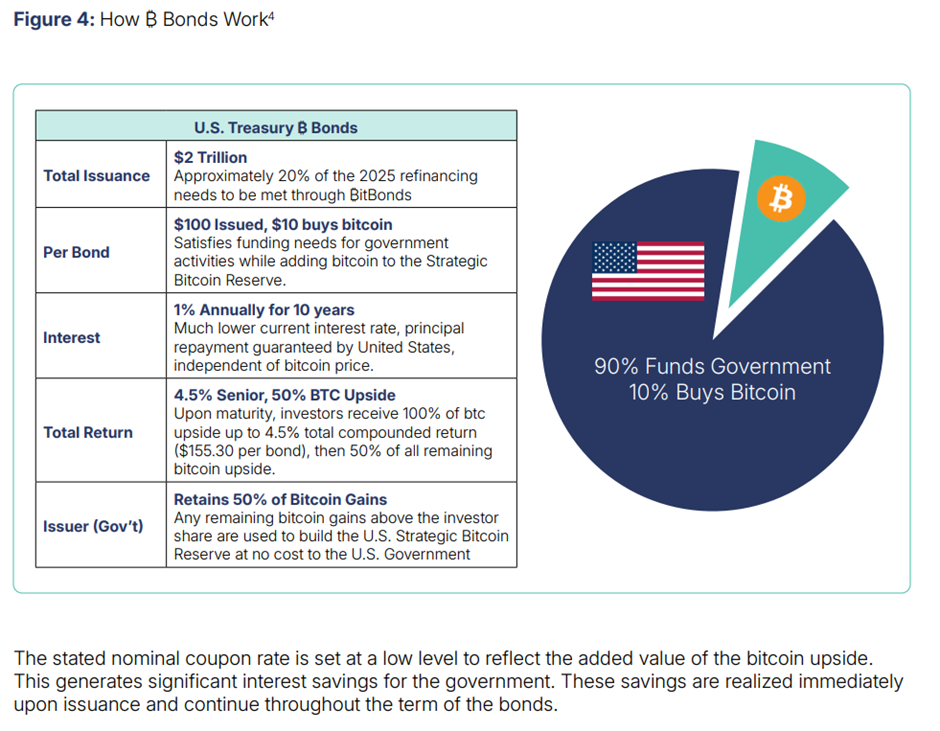

So, what are BitBonds? Basically, ₿ Bond is a hybrid bond comprising 90% UST’s and 10% BTC. ₿ Bonds are just as a conventional treasury security with an embedded bitcoin exposure that transforms their risk-return profile.

The U.S. Treasury would issue ₿ Bonds with a stated face amount (ex. $100) and maturity (for instance, 10 years). Unlike traditional bonds where all proceeds go to general funding, a fixed portion of each BitBond (10%) is used immediately to purchase BTC for the Treasury’s SBR. Most proceeds (90%) still finance government operations in the usual way. The government would pay a lower coupon (due to embedded BTC exposure) of 1% over the full life of the bond (ex. 10 years).

Investors would capture 100% of Bitcoin’s upside until their YTM reaches 4.5%, after which any additional gains would be split equally between investors and the Government. So, investors would receive a fixed coupon paid in USD and a variable BTC-linked payment at maturity based on the performance of the BTC purchased with bond proceeds.

The structure aims to align the interests of investors seeking protection from inflation and asset debasement with the Treasury’s need to refinance at competitive rates.

Source: Bitcoin Policy Institute, InterCapital

VanEck analysis suggests that issuing $100 billion in BitBonds with a 1% coupon and no Bitcoin upside would save the government $13 billion over the bond’s life. If Bitcoin appreciates at a 30% CAGR, the same issuance could yield over $40 billion in additional value, primarily from shared Bitcoin gains. The government’s breakeven (compared to traditional bonds) interest rate for BitBonds is estimated at approximately 2.6%[1] to achieve interest savings.

This model builds on the framework designed and implemented by Strategy at the corporate level, relying on the idea of BTC’s fundamentals positioning it as a pristine collateral. Strategy used convertible bonds to engineer a low-risk exposure to BTC.

A critical feature of the ₿ Bond structure would be that principal is fully protected by the full faith and credit of the United States Government. Bondholders receive their full principal plus interest at maturity, even if BTC does not perform well. That would ensure that ₿ Bonds maintain the core safety characteristic expected from Treasury instruments while providing exposure to potential upside from BTC appreciation.

However, challenges and risks to these products are many, such as implementation complexity and friction (potential political resistance and regulatory uncertainty), also from investor standpoint in terms of volatility of the bond in bear markets, capped upside, security and infrastructure concerns.

DISCLAIMER: The U.S. Treasury has not publicly commented on the VanEck’s proposal, and there is no indication that the government has taken any steps toward implementing such a financial instrument. The concept remains a theoretical proposal and has not been adopted into any formal legislative or fiscal policy.

[1] 2.6% breakeven interest rate represents the threshold below which issuing BitBonds becomes more cost-effective for the Treasury compared to traditional 4% fixed-rate bonds, even in scenarios where Bitcoin’s performance is modest or negative.