Have you noticed that Croatian bond spreads are getting tighter and tighter? As a matter of fact, CROATI 4 06/14/2035€ has been trading at Germany+26bps, while Austrian paper trades at Germany+32bps. What’s behind this spread tightening? Find out in this brief research piece.

Although the past week has been marked by frequently changing market direction (driven, of course, by headlines coming from Washington), it seems fixed income yields are steadily marching up, especially on the long end.

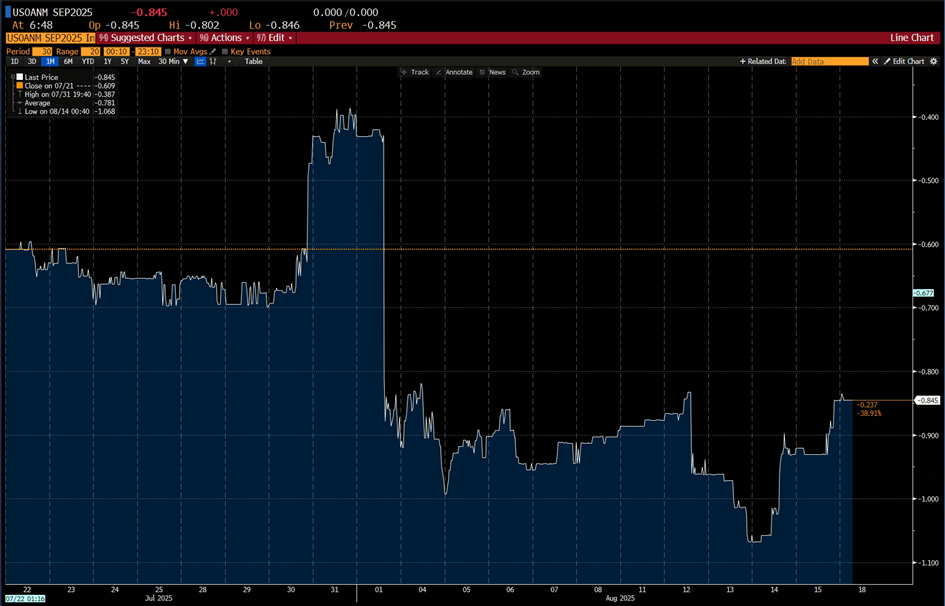

The opening week of August was actually quite bullish for bonds (i.e., yields dropped significantly), which came on the back of an unusually weak jobs report on August 01st. July headline payroll figure came at just 73k (versus 105k expected by market consensus), while the main surprise came from May and June revisions – combined, these amounted to 258k. This effectively means that in the period May-July, the US economy added merely 106k jobs, a sharp drop from 380k added a quarter before. This print couldn’t come at a worse time for seemingly hawkish FOMC – as a matter of fact, a few days ago, the US GDP print disclosed a significant slowdown in the latest quarter. Even Stephen Miran (chair of WH’s Council of Economic Advisers) had to concede that the payroll figure “isn’t ideal”, but “it’s all going to get much, much better from here”. Miran was later elected by President Trump to fill in the newly vacant seat at the FOMC belonging to Adriana Kugler, but we doubt this would happen before September 17th (next FOMC session) since this decision needs to be confirmed by the US Senate. Needless to say, markets were expecting half a rate cut at the September FOMC meeting before the lousy jobs figure (US0ANM SEP2025 on BBG), but scaled up these forecasts to a full cut in sessions thereafter.

September 2025 Rate Cut Expectations

Source: Bloomberg, InterCapital

Since the August 1st jobs report pushed the rate cut expectations to one full cut on the upcoming FOMC meeting, not much has changed. This comes against the backdrop of Scott Bessent (some pundits treat him as the shadow FED chairman) pushing for the FED to deliver a jumbo cut of 50bps on the upcoming meeting. EGB traders remember that day very well since Bund yields dropped from 2.75% to 2.65% following a commensurable move in long-end USTs. Translated to prices, that day, September Bund futures briefly pierced the 130.00 level and gave fixed income traders one last chance to open up interest rate hedges.

The same day, the US core CPI came in just slightly above the expectations (+3.1% actual versus +3.0% expected by market consensus). This small beat, coupled with dovish shadow FED and real doves in FOMC (Waller and Bowman) getting louder, managed to move 5Y5Y inflation expectations a tad higher and consequently cause another sell-off in core rates. There is another angle to the recent bond sell-off – some pundits think this happened because all those expectations about new issuances flooding the European markets are getting funneled into bond prices. Pay attention that this is merely an angle of observing and not really supported by any of the imminent economic data. But it’s definitely gaining traction.

CROATI 4 06/14/2035€ Spread to Germany

Source: Bloomberg, InterCapital

So where do we go from here? First of all, notice that periphery spreads are getting tighter and tighter – lo spread (10Y BTPS YTM – 10Y German YTM) has contracted to merely 80bps (down from 150bps a year ago). One of the most traded Croatian bonds, CROATI 4 06/14/2035€ has been trading at 3.03% YTM (108.10 price, B+26bps), and what catches the eye of any fixed income trader is that this is merely 26bps above the German benchmark (as depicted on the chart). For comparison, Austria is 6bps wider (3.09% YTM)! Spreads on Spanish bonds have been getting tight, but not this tight – SPGB 3.2 10/31/2035€ has been trading at 3.34% YTM, which is about 55bps above the German curve.

Not all spread tightening has been equal – in the case of Croatia, local bid stemming from domestic banks scooping up all CROATI€ they could find to feed their ALM departments has left a number of dealers short on the paper, and they are now struggling to cover. Can this drag on? We believe it could, since there will be no Croatian Eurobond placements before March 2027, and fund managers are not very keen to cut Croatian exposure. So if you have them, it’s not a bad idea to hold them close to your chest because they might just have more room to go on the back of illiquidity.