On 17th of July 2025, the US House of Representatives passed the Genius Bill with a 308-122 vote, with significant bipartisan support – 102 democrats voted yes. Since the legislation already passed the Senate on June 17th, the Bill became the first official crypto-related legislation, enabling and regulating payment stablecoin issuance. On the same day, the House also passed the Clarity Act in a 294-134 vote and the Anti-CBDC Surveillance State Act in a narrower 219-210 vote. The two bills are on their way to the Senate.

True to its name, “Crypto Week” delivered in terms of legislative changes by passing three crypto-related Bills in one day. The conservatives succeeded in merging the vote on Genius Act and Clarity Act with the controversial Anti-CBDCSS Act, which bans future Central Bank digital currency issuance, cementing the stablecoin narrative. The Genius Act defines payment stablecoins as digital assets designed for payment and settlement, listed by a permitted stablecoin Issuer that guarantees to repurchase, redeem, or convert the coin at a value stable relative to USD, maintaining a peg. The law introduces an option permitting Issuers smaller than $10 billion to opt into a state-level regulatory framework. Either federally or state-chartered, all permitted stablecoin Issuers must comply with the Bank Secrecy Act, anti-money laundering, and KYC requirements. All Issuers must back their coins on a 1-to-1 basis with eligible assets, such as US currency, insured bank deposits, T-bills, notes or bonds with remaining maturity of 93 days or less, money received under repurchase agreements, reverse repurchase agreements, money market funds invested in these securities, and any other similar liquid, high-quality approved instrument. Also, certain reserve assets in tokenized form could be considered, such as tokenized treasuries. The main criticism of the Genius Act lies in the President’s ties with the industry and the direct benefit for his family wealth, since his own company World Liberty Financial (WLFI) has issued a stablecoin called USD1. The legislation has attracted a lot of interest from large banks and retailers, such as JP Morgan, Amazon, Walmart, Shopify, PayPal, Airbnb, etc. Genius Act explicitly bans yields on payment stablecoins.

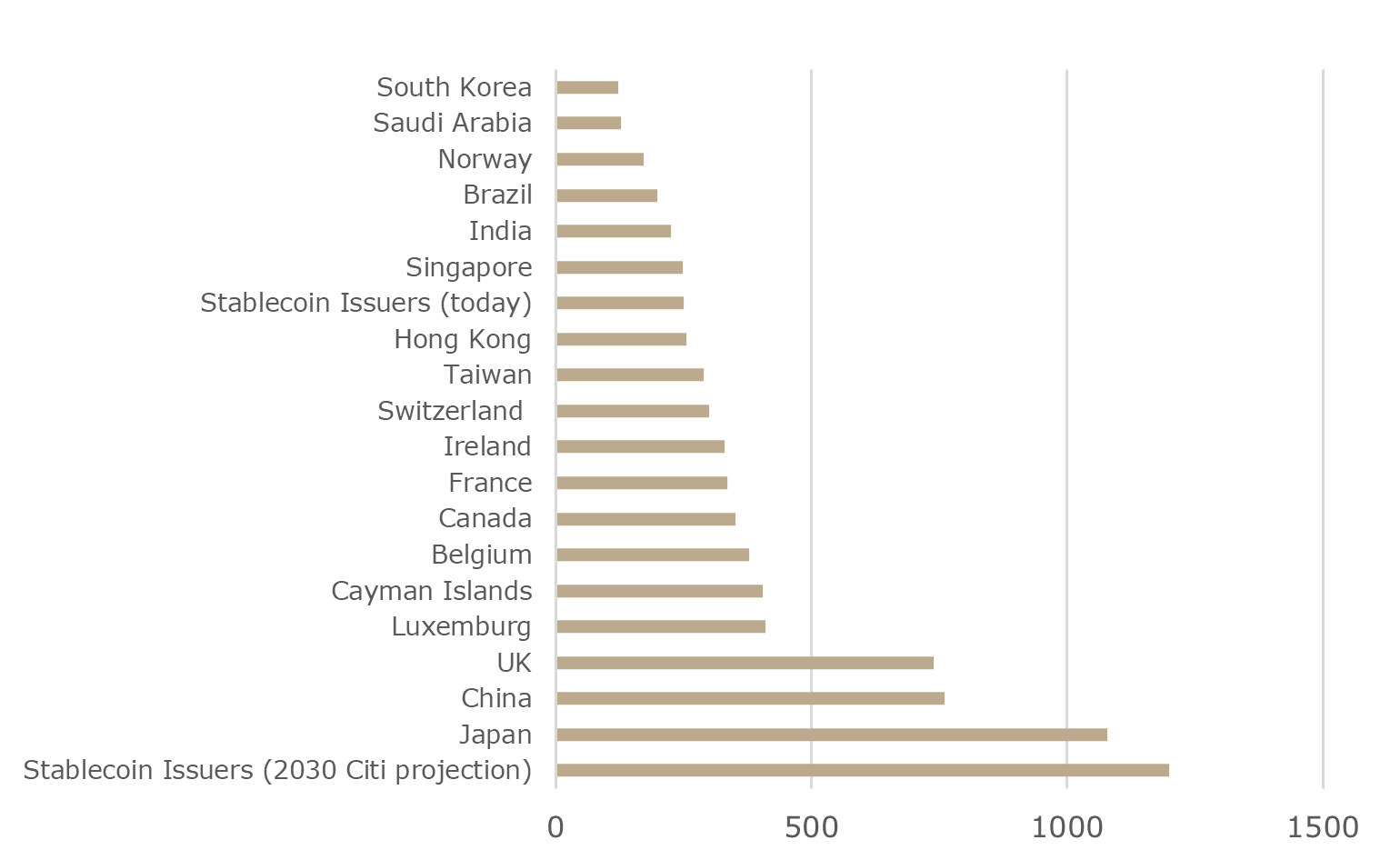

Stablecoin Issuers are currently estimated to hold more than $200 billion of US debt, while dollar-backed stablecoins have been topping $100 billion in the daily trading volume since June. Citigroup estimates the potential market size for stablecoins at $1.6 to $3.7 trillion by 2030.

Holdings of USTs in billions $

Source: US Treasury, Citigroup outlook, InterCapital

The third piece of the legislation, called the Clarity Act, is supposed to have a potentially even bigger impact on crypto markets. Advanced on June 11th, by the House Financial Services Committee in a 32-19 vote, with the House Agriculture Committee also passing the bill 47-6. The bill’s two marked-up versions, also known as H.R. 3633, were consolidated into one text for floor consideration by the full House of Representatives and finally passed on Thursday. The legislation seeks to end jurisdictional ambiguity by assigning regulatory oversight of digital assets to either the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC). As a law, the CLARITY Act would formally remove most of the jurisdiction from the SEC to the more hands-off CFTC as the primary regulator for most digital assets. Issuers could still choose to do a SEC registration if they seek to sell directly to institutional investors.

So, what is the CLARITY Act? The CLARITY Act defines a “digital commodity[1]” as an asset intrinsically linked to a blockchain system and places these under the primary authority of the CFTC, which would oversee spot markets for such assets. In contrast, the SEC would retain its jurisdiction over the offering of “investment contract assets,” which are digital commodities sold or transferred as part of an investment contract. This approach focuses on the nature of the transaction during capital-raising phases, rather than classifying the underlying asset itself as a security in perpetuity. The Bill defines the concept of a “mature blockchain system[2]” referring to a network not “controlled by any person or group of persons under common control.”

[1] Digital commodity definition does not include several types of assets, referring to permitted payment stablecoins, regulated derivatives, pooled investment vehicles, banking deposits, and tokenized real-world assets. If the capital raising uses the digital asset, then it may be classified as an “investment contract asset” at inception. If the digital asset is offered directly via airdrop, mining, or otherwise distributed for nominal consideration, referred to as an “end-user distribution,” then the digital asset may be classified as a digital commodity at inception.

[2] To qualify as a mature blockchain system, the blockchain must meet specific criteria, including that it is functional for executing transactions, accessing services, or participating in the validation or governance process, composed of open-source code and that its native currency’s ownership is not concentrated to a degree where a single person or a group (including affiliates) holds 20% or more of the token supply.