Stablecoins can resemble a “narrow bank” or a 100% reserve bank, a well-known payment-only banking structure that monetary economists have studied for more than half a century. Built in this manner, stablecoins resemble currency boards as they tie a foreign currency to the dollar and maintain dollar reserves to support redemption commitments. The objective of stablecoins is to mimic the safe asset features of commercial bank money. However, to realize those advantages, stablecoins need to fill the gap between them and commercial bank money: strong, consistent oversight and regulation along with suitable public safety nets. Robust regulation, along with deposit insurance and the additional public backing that accompanies it, is what renders bank deposits an acceptable and recognized form of currency. Strong oversight, combined with deposit insurance and other public support that comes with it, is what makes bank deposits an acceptable form of money. Currently, stablecoins do not have that oversight, and this lack poses risks. This 2nd piece aims to explore the safety and soundness of stablecoins and the need for a clear regulatory regime for stablecoins in the United States.

FRAGMENTATION – At this moment, most popular blockchains are distinct from each other, resulting in a fragmented digital realm. Companies aiming to expand across blockchains are pursuing technical solutions for cross-chain interoperability. Will this eventually turn out to be efficient, or will there be several rivaling ecosystems that we witness, as today? Alternatively, a stablecoin market featuring a high degree of interoperability could support a variety of stablecoin issuers and blockchain networks, providing consumers with a choice in stablecoins and technologies. The fragmentation concerning the use and acceptance of stablecoins will hinder scaling efforts and influence the development of stablecoin use cases. The more people will accept a stablecoin, the more convenient a stablecoin will be (more utility – network effect). Fragmentation in regulation, more specifically, the emergence of different global stablecoin regulatory regimes, creates the potential for conflicting regulation domestically and internationally. This regulatory fragmentation might complicate the ability of U.S. dollar stablecoin issuers to compete on a worldwide level. Scale is essential for any payment method to reach its maximum potential. For instance, according to Europe’s Markets in Crypto-Assets Regulation, stablecoin issuers can generate interest from their reserve assets as part of their business strategy, while alternative regulatory frameworks under consideration would mandate that reserves for stablecoins considered systemically significant be maintained as non-interest-earning central bank deposits, restricting stablecoin issuers to a certain business model. At the national level, state regulators have played a crucial role in the growth of the stablecoin market, with many states currently working on establishing state laws or completing new regulations concerning stablecoin issuance. There is a possibility that state regulations might clash, which could hinder the use of the same stablecoin in all states and limit its scalability. Similar to the dual banking system in the United States, a collaborative approach involving both state and federal regulators can foster innovation while also realizing the economies of scale associated with a unified set of market regulations. Various regulatory frameworks are establishing different reserve assets and redemption terms for stablecoin issuers, leading to additional possible fragmentation of the regulatory regime. In Europe, non-systemic issuers must maintain at least 30 percent of their backing assets in bank deposits, and regulators have also suggested limits on concentration per bank. This is unlike the requirements of certain issuers regulated by U.S. states. To compete on a global level, issuers of stablecoins must issue the same stablecoin across various regimes, each with distinct reserve asset and redemption criteria. Establishing consistency at the federal level may enable federal officials to engage in discussions with international counterparts to ensure that global regulations benefit U.S. consumers and businesses, positioning the U.S. as a regulatory leader for an asset class primarily valued in its national currency.

REGULATORY LANDSCAPE – Following years of ambiguity, regulation for stablecoins is now increasingly progressing in Congress. Three rival bills—the GENIUS Act, the STABLE Act, and an unnamed suggestion from Rep. Maxine Waters (D-CA)—are contesting to shape the future of digital currencies in the U.S. This long-awaited push for defining regulation could decide if stablecoins can evolve into a common financial instrument or stay stuck in regulatory uncertainty. Earlier this month, the Senate Banking Committee moved forward with the GENIUS Act, achieving an 18–6 bipartisan vote, representing the most important progress toward a federal framework for stablecoins. The legislation characterizes a “payment stablecoin” as any cryptocurrency utilized for payments or settlements, whereby the issuer must redeem it for a predetermined amount of U.S. dollars. Both the GENIUS ACT and the STABLE ACT create the initial federal licensing structures for stablecoins in the U.S. The GENIUS Act sets licensing, reserve, and disclosure obligations while emphasizing consumer rights in bankruptcy situations. It oversees both bank and nonbank issuers, maintaining a balance between state and federal regulation. Issuers with a market cap of over $10 billion, such as Tether and Circle, are required to adhere to OCC and Federal Reserve regulations, whereas smaller issuers can choose state oversight. Nevertheless, an important difference is that the STABLE Act imposes a two-year pause on the issuance of new “endogenously collateralized stablecoins”—ones solely backed by other digital assets—unless they were already in existence prior to the bill’s enactment.

Significantly, the GENIUS ACT classifies payment stablecoin issuers as financial entities according to the Gramm-Leach-Bliley Act, mandating them to maintain customer confidentiality and safeguard private personal data. According to the GENIUS ACT, stablecoins that gain regulatory approval must be supported by high-quality liquid US assets, such as treasury bills and insured deposits. The dual regulatory framework set up by these bills is essential. The legislation enables industry participants to innovate at their own speed by balancing federal and state oversight while ensuring regulatory protections are in place.

The Division of Corporation Finance of the Securities and Exchange Commission (SEC) released guidance to clarify when specific stablecoins might not be classified as securities according to federal securities laws. This progress occurs as Congress is currently reviewing bills — specifically the GENIUS Act and the STABLE Act — that would clearly exclude payment stablecoins from securities definitions and create an all-encompassing federal regulatory system for payment stablecoins. The timing indicates that the SEC is trying to offer provisional clarity as legislative solutions are still awaiting resolution.

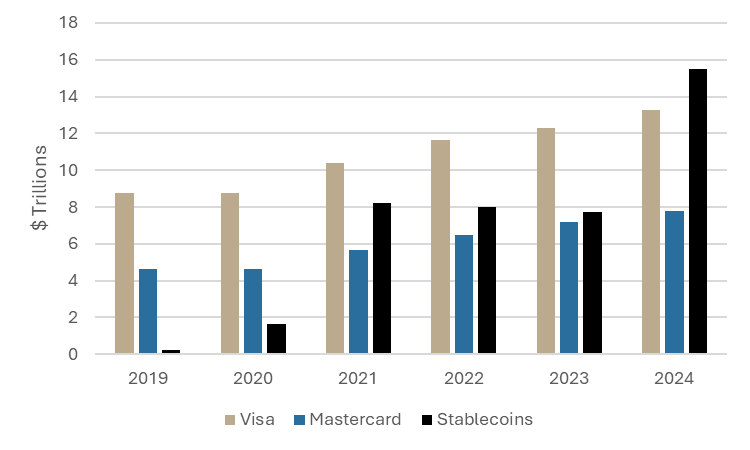

Stablecoins vs. Traditional Payment Processors

Source: Visa, Mastercard, ARK Invest Big Ideas 2025 Report