For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds.

Yesterday we presented you with a brief asset structure analysis of Croatian UCITS funds. Consequently, for today we decided to present you with a short analysis of the asset structure of Slovenian mutual funds.

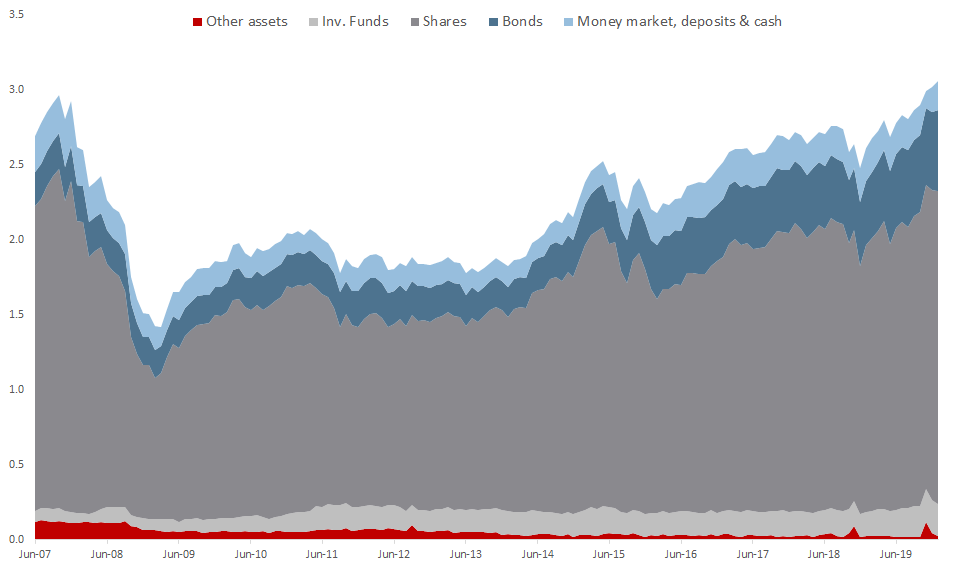

When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their assets structure in the past decade.

Unlike the Croatian funds, which have in the past years witnessed an increase in debt securities in their asset structure (65.9% of asset structure in 2019), Slovenian asset managers are more prone to investing in equities. As of January 2020, shares account for 68.3% of the total assets structure of mutual funds, which is slightly below the historic average (in the observed period) of 70.3%. Note that the equity holdings of Slovenian mutual funds reached their peak in September 2007, when they accounted for 76.4% of the total asset structure.

Next come bonds, which make up for 17.8% of the total asset structure, and which have in the past years been witnessing a steady increase. Investment funds and money market follow deposits & cash make up 7% and 6.2%, respectively.

As of January 2020, Slovenian mutual funds manage EUR 3.05bn (+16.9% YoY), which is at its historic high. It is worth noting that mutual funds were at their low in March of 2009, when the total assets under management amounted to EUR 1.42m. This occurred partly due to lower asset value, as well as due to funds outflow as investors pulled out their funds.

Source: Securities Market Agency, InterCapital Research