Despite the negative impacts of Covid-19, Sava Re expects to see higher revenues and higher net profit than originally planned, because of the acquisition of Vita.

Sava Insurance Group has published a revised 2020 plan for two reasons: the acquisition of the life insurance company NLB Vita, which was integrated into the Group on 31 May 2020, and Covid-19 and the related impacts on Group companies’ operations.

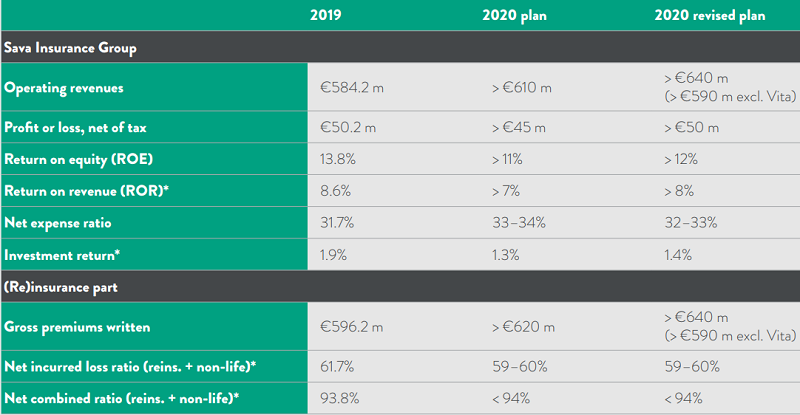

Sava Insurance Group Revised 2020 Plan

Source: Sava Insurance Group

*Excluded effect of exchange differences for 2019. The rate of return on investment does not include subordinated debt expenses. The net expense ratio of the Group for 2019 and 2020 does not include the positive difference between fair value of net assets acquired and purchase value of the investment (2019: ERGO, 2020: Vita).

Compared to the previous year, the Group expects GWPs on the non-life segment in Slovenia to decline by 2%, reflecting the decline in new car sales aggravated by Covid-19 (original plan: 3% growth). Regarding Life GWPs in Slovenia, the Group expects an increase of 43%, which can be attributed solely to Vita’s integration into the Group starting with June 2020, whereas the volume of life business of Zavarovalnica Sava has been shrinking due to the large number of policies maturing (original plan: 9% decline in gross premiums). Covid-19 has also made underwriting of these policies difficult due to required social distancing and movement restrictions.

Also as regards insurance business outside Slovenia, the Group expects a decline in gross premiums in 2020 due to the impacts of Covid-19. Non-life insurers outside Slovenia expect premiums to decline by 5% (original plan: 6% growth), whereas life insurers still expect premiums to grow at 9%, which is more modest than originally planned (original plan: 15%).

In 2020, the Group’s non-life insurers will focus in particular on the development and expansion of the existing sales network, the diversification of their portfolios by means of new products, and the strengthening of bancassurance as a sales channel. In their development of insurance products and services, the Group’s life insurers will focus in particular on reducing or discontinuing guaranteed rates in 2020 in view of the low interest rates prevailing in the financial markets.

As regards reinsurance business, the Group expects gross premiums to grow by 6% (original plan: 8%), reflecting increased business volume in new markets, and it will seek to diversify the portfolio by both region and partner. The downward revision of planned growth is explained with the expected cooling of the majority of economies abroad where the reinsurer operates.

As regards its investment policy, the Group will try to maintain high security and low price volatility of assets covering liabilities under insurance contracts, high liquidity and risk diversification. Investment management in 2020 will be affected by the continued low interest rates. The investment return is planned at 1.4%, which is 0.1 p.p. higher than originally planned, reflecting the slightly longer duration of Vita’s portfolio. The investment portfolio structure will also remain relatively conservative in 2020, featuring a high share of bonds and other fixed-income investments and a high credit rating profile, with the share of equity securities and infrastructure projects increasing slightly. Vita excluded, the revised plan provides for a lower investment portfolio value, reflecting the financial markets decline in 2020.

The Group intends to increase its cost-effectiveness in 2020. Compared to the original plan, the net expense ratio will improve by 1 p.p., mainly due to the following: the expected decline in the ratio in the reinsurance segment, Vita’s integration into the Group, as the company has a net expense ratio that is below the Group’s average, and certain cost optimisation measures adopted to mitigate the negative impacts of Covid-19 on the Group’s operations.

The Group expects its net profit to exceed EUR 50m (original plan: > EUR 45m) and operating revenues to exceed EUR 640m (original plan: EUR 610m). Excluding the impact of Vita’s acquisition, the net profit of the Group is planned at the level of EUR 41m (down 9% compared to the original plan), and its operating revenues at EUR 590m (down 3% compared to the original plan).