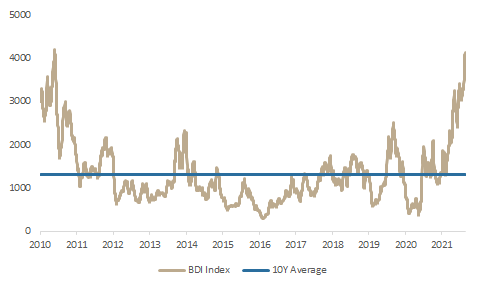

The BDI Index reached a level not seen since 2010 adding additional fuel to the dry bulk segment which already saw a lot of interest from investors this year.

The Baltic Dry Index or BDI index is a composite of various shipping rates used to transport dry bulk containers on merchant ships. Although the index is useful to determine the demand for dry bulkers, it can also be used as an important economic indicator. Namely, the use of this index as an indicator is a variation on the theme Charles Dow employed a century ago: transportation activity implies future commerce.

A change in the Baltic Dry Index can give investors insight into global supply and demand trends. Many consider a rising or contracting index to be a leading indicator of future economic growth. It’s based on raw materials because the demand for them portends the future. These materials are bought to construct and sustain buildings and infrastructure, not at times when buyers have either an excess of materials or are no longer constructing buildings or manufacturing products.

BDI Index Historic Performance

Amid the strong demand surge for dry bulkers the index has closed yesterday’s session at 4,201 points, significantly above its 10-year average and is now actually close to its high, last witnessed more than 10 years ago.

Recent gains in the index can be attributed to an overall rebound in commodities demand, coupled with shipping constraints, especially in China. However, renewed coronavirus restrictions in China could affect demand and that may be apparent in the coming weeks.

Impact on Croatian Dry-Bulkers

Croatian dry bulkers have also benefited from the strong surge in demand with all of them seeing their share price going up several times since the beginning of 2021, as presented in the chart below.

YTD Performance of Croatian Dry-Bulkers (%)