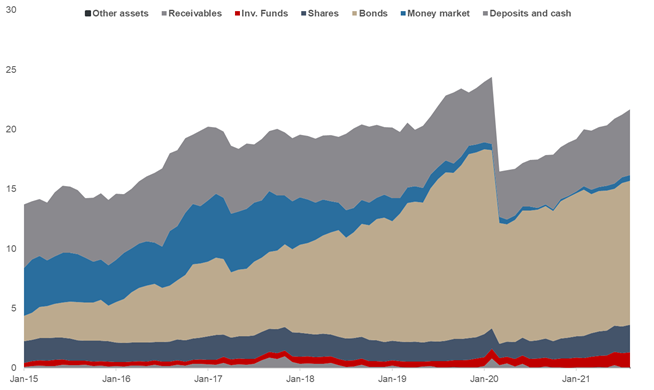

NAV of Croatian UCITS funds reached HRK 21.2bn, indicating a 25.4% YoY increase.

Croatian asset managers are large investors in the Croatian equity and bond market and they hold a significant amount of retail investments so they have an important role on the Croatian financial market. It is interesting to see how they have performed lately and the last reporting period is for August. As visible from the graph below, NAV of all funds has witnessed a steady increase for the 17th consecutive month, and as of end-August stood at HRK 21.2bn (+2% MoM). This represents an increase of 16.1% YTD, and is gradually converging towards pre-pandemic times. However, this still represents a decrease of 8.3% compared to the pre-pandemic highs (Feb 2020). On a positive note, this represents the 10th consecutive month of positive net contributions to funds. Meanwhile, in August net contributions amounted to HRK 355.2m. Of that 51% comes from bond funds, while 21% comes from equity funds.

On a YTD basis, the biggest absolute increase of AUM was observed in deposits and cash by HRK 1bn (+23%). Shares follow with an increase by as much as HRK 558.7m (+32%). On a MoM basis, deposits have observed the highest absolute increases by HRK 232m (+4%). Looking at the asset composition of Croatian UCITS funds, shares account for 10.6% of the total AUM, the highest seen since 2016. We also note that domestic shares account for 26.2% of total equity holdings. Domestic equity has so far in 2021 has seen a 18.8% YTD increase, while foreign equities have observed a 37.5% YTD increase.

Bond holdings continue to be the largest asset class of Croatian UCITS funds accounting for 55.6% of the total AUM. We note that this does represent a decrease by as much as 6.6 p.p. YTD.

Total Assets of All Croatian UCITS Funds (2015 – August 2021) (HRK bn)

Source: HANFA, InterCapital