Here you can find a short asset structure analysis of Croatian Mandatory Pension Funds.

Croatian mandatory pension funds represent an important institutional investor on the Croatian and Slovenian capital market as their total asset value amounts to EUR 14.9bn. So, it is particularly interesting to see how they have been affected during the ongoing Covid-19 situation. Given that we observed partial recovery on the global financial markets in April it is worth seeing how Croatian MPF performed during that month. It is worth to mention that monthly inflow to all pension funds exceeds app. EUR 80m.

According to the report, NAV of all pension funds has at the end of April 2020 amounted to HRK 111bn which is a decrease of 1.46% (or HRK 1.7bn) compared to the end of 2019. YoY increase of NAV has amounted to 6.94% as new funds for members were paid-in. Note that the return of Mirex category B funds has experienced a decrease of -3.21% YTD in April 2020, but return has also shown indication of rebound with 1.86% monthly increase.

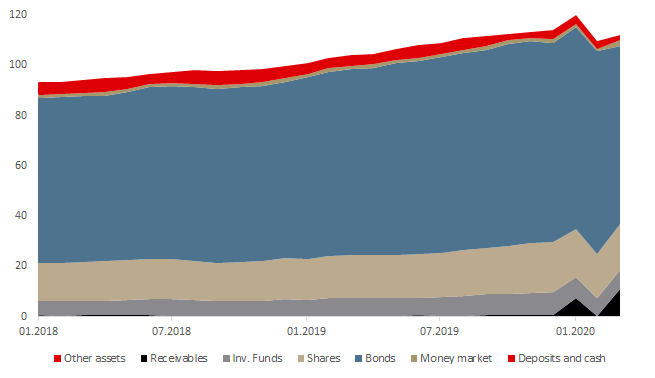

Looking at the asset structure of Croatian MPF funds, it seems that pension funds have not considerably changed their composition by categories, which can be seen in the graph below. Since the beginning of 2020, we witnessed a decrease of bonds in the assets structure which went from 71% in December 2019 to 63% in the April of 2020. The decrease was compensated by the growth of receivables in February and April 2020 when they had amounted to 6% and 10% of the asset structure (or HRK 7.5bn and 10.8bn). As a comparison, in February and April of 2019 receivables’ share in assets has amounted to 0.04% and 0.15%, respectively. This discrepancy in asset structure can be explained by strong maturity of bonds or coupons at the end of April or trading activities. Therefore, we expect that the structure of AUM in May 2020 will not change materially compared to March 2020, when pension funds had 74% of all assets invested in bonds. Next come shares that amount to 17% of total assets, which is app. the same as the average of the last two years (16%). Investment funds are the third biggest category with 7% in total assets structure. This is the same percentage as the average in the last two years. Deposits and cash have in April 2020 amounted to 2% of total assets while its 2-year average is at 4%.

Total Assets of Croatian Mandatory Pension Funds (HRK bn)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research