Financial institutions loans growth slowed down in May to 6.7% YoY, while it was flat compared to April. Total financial institution’s loans amounted to HRK 272bn, while its biggest categories household loans and corporate loans growth decreased to 4.2% YoY and 3.8% YoY, respectively.

Croatian National Bank (HNB) published their monthly statistical report on loans placement of other monetary financial institutions. According to the monthly statistical report as of end May, total financial institution’s loans amounted to HRK 272bn, while their growth has amounted to 6.7% YoY which is a slow-down compared to previous months when higher growth was evidenced. Its biggest categories household loans and corporate loans evidenced growth of 4.2% YoY and 3.8% YoY, which is also a decrease compared to previous months and is in line with the slow-down in the economy caused by lock-down and Covid-19 pandemic.

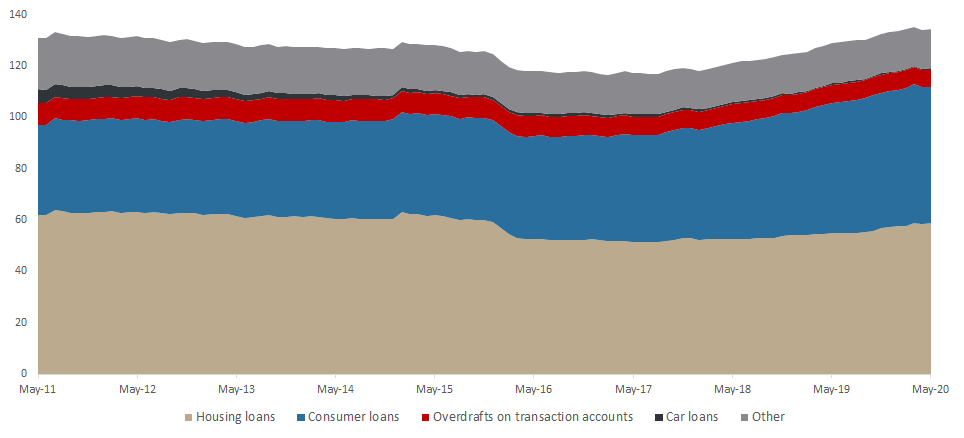

Total loans issued to households amounted to HRK 134.31bn, representing an increase of 4.2% YoY (or HRK 5.38bn). Such an increase was mainly driven by almost solely by a rise in housing loans (+7.5% YoY or HRK 4.1bn) and consumer loans (+4.6% YoY or HRK 2.33bn). It is worth noting that these two items account for 83.4% of the total loans to households. The mentioned increase was partially offset by a decrease in almost all other loan segments. It is worth noting that car loans observed a sharp drop of 20% or HRK 119.80m. This does not come as a surprise, given the low car sale trend which has been observed throughout this year.

Loans to Households (Jan 2016 – May 2020) (HRK bn)

However, if we were to observe the YTD loan development (to households), one can observe a 0.9% increase by HRK 1.19bn. Such an increase came almost solely on the back of housing loans which increased by HRK 1.48bn or 2.6% YTD. It is worth mentioning that majority of the increase came in the months prior to the Covid-19 outbreak, while in April and May we observe a decrease of 0.6% MoM and an increase of 0.7% MoM, respectively. It is worth noting that it is reasonable to expect a negative trend going forward throughout the year, given the many uncertainties and risks in the labor market which was caused by the ongoing Covid-19 pandemic.

Of other loan segments, consumer loans observed a slight increase of 0.2% to HRK 53.05bn, while mortgage loans increased by 7.4% to HRK 2.02bn. On the flip side, the highest decrease was observed in credit card loans (-5.7%) to HRK 3.63bn and other loans (-1.5%) to HRK 9.55bn.

Structure of Loans to Households (May 2020)